- Pros: Sophisticated integration with online sales. Excellent CRM. Advanced product management. 24/7 support.

- Cons: Not worth the cost without online store. At least one subscription required.

- Best for: Retailers who need an extensive online store that’s connected with their POS system.

Overview

In brief

How it works

Our opinion

In detail

Pricing

Transaction fees

Card reader and hardware

Getting started

App features

Integrations

Offline mode

Customer support

Who is it for?

MobileTransaction has personally tested Shopify POS to give an honest appraisal of the software. Opinions are the editor’s own.

How it works

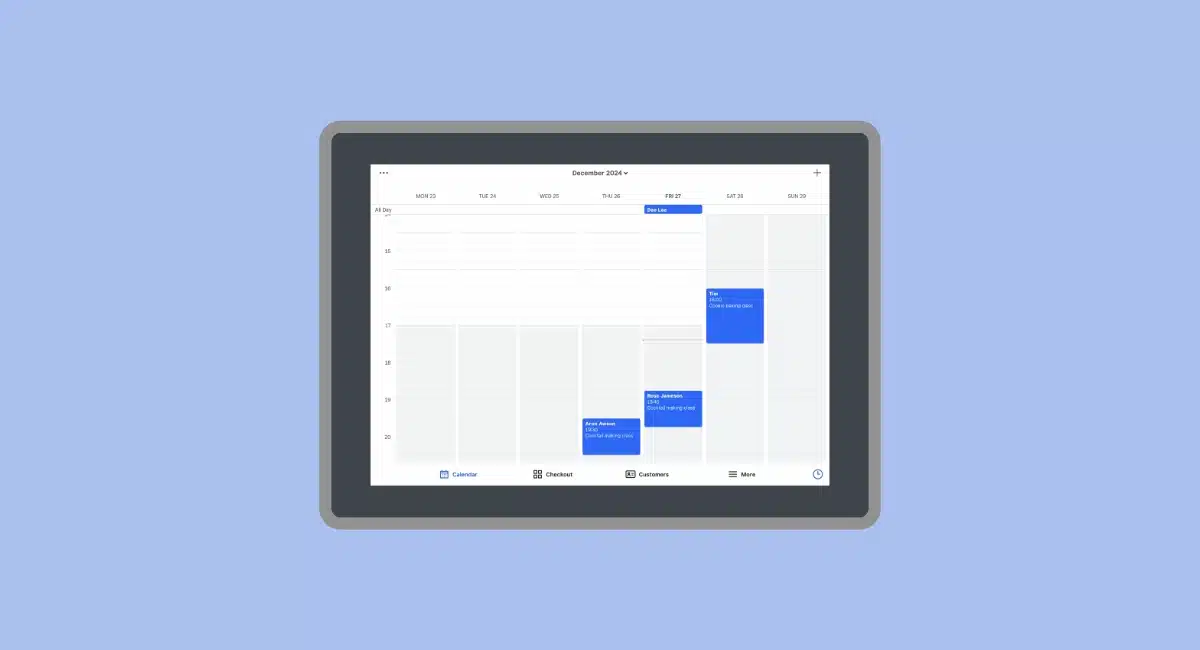

With the Shopify POS app, you can turn an iPad, iPhone or Android device into a portable point of sale for your in-store sales.

The software keeps all online and in-store sales synced in the cloud, so inventory and reports are always up to date wherever you access it.

The smooth ecommerce-POS integration is designed for an organised sales experience across multiple retail sales channels. In our experience, this is quite important for fostering good customer relationships (and thereby selling more).

Credit: Shopify

The POS app is available on iPad, iPhone and Android devices, but the latter two have some limitations.

Shopify POS works with a card reader, barcode scanner, cash drawer and receipt printer, so it’s ideal for a brick-and-mortar retailer. For the full range of POS features, however, a monthly POS subscription is required.

This is only worth considering if you want to pay for Shopify’s ecommerce features in the first place – otherwise, other retail POS systems may be better.

Our opinion: improved, but still not cheap

Shopify POS has improved in Australia in the last few years, as it now works on most devices, and there’s a standalone subscription for the full range of POS features. It used to be the case that an ecommerce subscription was required before you could even add the full suite of POS features.

“It’s definitely a good, quite clever point of sale system that I liked using, but I think Shopify POS is only worth the subscription and card rates if you sell online too. The backend software is clearly catering towards selling across retail channels.”

– Emily Sorensen, Senior Editor, MobileTransaction

Overall, Shopify POS is a decent choice for multichannel businesses already selling online through Shopify. If you don’t need a full-fledged online store, then other POS systems may be better, as you get more point of sale features for less money.

Pros and cons of Shopify POS:

Pros

Cons

Subscription pricing

In order to use Shopify POS, you must have a subscription first. There are two ways to go about this.

You can subscribe to either any ecommerce plan, which includes access to basic POS Lite features, and then (if you need it) add Shopify Retail per location you want to use complex POS Pro features. Or you can just subscribe to Shopify Retail, which includes POS Pro features for one location and only basic online selling features.

The eccommerce plans are available on a monthly or annual subscription and can be cancelled any time. Users can choose between Shopify Starter, Basic Shopify, Shopify and Advanced Shopify subscriptions. There is also a Shopify Plus plan, but it’s more suited for large or high-volume businesses.

| Shopify Starter |

Basic Shopify |

Shopify | Advanced Shopify |

|---|---|---|---|

| Limited online store | Full online store | Full online store | Full online store |

| $7*/mo | $56*/mo | $149*/mo | $575*/mo |

| Domestic cards: 1.75% + 30¢ Amex, foreign cards: 2.9% + 30¢ /online transaction |

Domestic cards: 1.75% + 30¢ Amex, foreign cards: 2.9% + 30¢ /online transaction |

Domestic cards: 1.6% + 30¢ Amex, foreign cards: 2.8% + 30¢ /online transaction |

Domestic cards: 1.4% + 30¢ Amex, foreign cards: 2.7% + 30¢ /online transaction |

| Max. staff accounts | |||

| 1 | 6 | 16 | Unlimited |

| Max. locations | |||

| 1 | 10 | 10 | 10 |

*Australian dollars, excluding GST. Pricing for monthly subscription payments – annual payments cuts the price by 25%.

While you can’t set up a full online store on Shopify Starter, you still get a limited online store with product pages to share online via links and buttons. This way, you can sell on social media, through messaging or anywhere else online.

Basic Shopify is Shopify’s cheapest ecommerce plan with a full online store, 24/7 customer support and an online card processing rate of 1.75% + 30¢ AUD for Australian cards or 2.9% + 30¢ AUD for Amex and international cards. The Shopify plan comes with professional reports for better analytics, more user accounts and a lower online transaction rate of 1.6% + 30¢ AUD for Australian cards or 2.8% + 30¢ AUD for Amex and international cards.

The pricier Advanced Shopify plan includes custom report creation tools, customer analytics, real-time calculated carrier shipping, unlimited staff accounts and the lowest possible rate of 1.4% + 30¢ AUD for Australian cards and 2.7% + 30¢ AUD for Amex and international cards.

In our opinion, businesses that have a high sales turnover should consider the Shopify and Advanced Shopify plans for its lower processing rates.

All of these plans allow you to download the Shopify POS app and use the free Shopify POS Lite features.

Whether you’re on an above ecommerce plan or not, businesses need to subscribe to Shopify Retail for $129 AUD + GST/month per location to access POS Pro features.

| Shopify POS Lite | Shopify Retail / POS Pro |

|---|---|

| Included in all ecommerce plans | $129*/mo per location |

| Suitable for a market stall holder, pop-up shop or mobile merchant | Suitable for brick and mortar shops, multiple staff and multiple locations |

*Australian dollars, excluding GST.

Shopify offers a 14-day free trial covering both the ecommerce and POS features. We would absolutely recommend trying that out first. But even then, it can be hard to know exactly which plan is most suitable for you. Once you pay for a monthly subscription, the plan can be upgraded or downgraded any time so you are not stuck unless you pay for an annual subscription upfront.

Shopify POS transaction fees

The Shopify POS terminals accept Visa, Mastercard, eftpos, American Express, UnionPay, Apple Pay, and Google Pay payments. Transaction fees are the same regardless of whether the card is debit, credit, premium, domestic or international.

“Until recently, Australian eftpos debit cards weren’t accepted unless they were co-branded with Visa or Mastercard, but we’re pleased to see Shopify now accepts all eftpos cards through the POS system. eftpos is not cheaper to accept than Visa or other cards, though.”

– Emily Sorensen, Senior Editor, MobileTransaction

Like the online rates, card reader payments are cheaper on more expensive plans.

| Subscription | Shopify card reader fee |

|---|---|

| Shopify Starter | 5% |

| Basic Shopify or Shopify Retail only | 1.75% |

| Shopify | 1.85% |

| Advanced Shopify | 1.75% |

Shopify Starter charges a whopping 5% per POS transaction, but this drops down to 1.95% on Basic Shopify. The rate falls only slightly with Shopify and Advanced Shopify (1.85% and 1.75% per transaction respectively). These fees are okay, but not as competitive as they used to be (1.5%-1.9%).

Let’s take a few examples. If your retail store has a card turnover of $8,000 per month, the 5% rate will cost $400 in card fees, and the 1.95% rate would cost $156 – quite a difference.

So if you’re planning to sell much in person, it makes sense to go for either Shopify Retail, Basic or a higher plan with a rate of less than 1.95%.

If the monthly card turnover is $20,000, the Advanced package will leave you with $350 in fees, and the Basic package $390 – not much of a difference considering the Advanced Shopify plan costs $519 AUD + GST more than Basic Shopify.

Card payments can take up to 5 working days to reach your bank account, which is not exactly the fastest.

Accepted payments

Businesses can use a standalone EFTPOS terminal, and it will not incur any transaction fees for Shopify, only for the chosen card machine provider.

Supported payment gateways incur an added “Shopify transaction fee”, but this refers to the online store only. This is Shopify’s way of encouraging people to use their online payment system.

Card reader and POS hardware

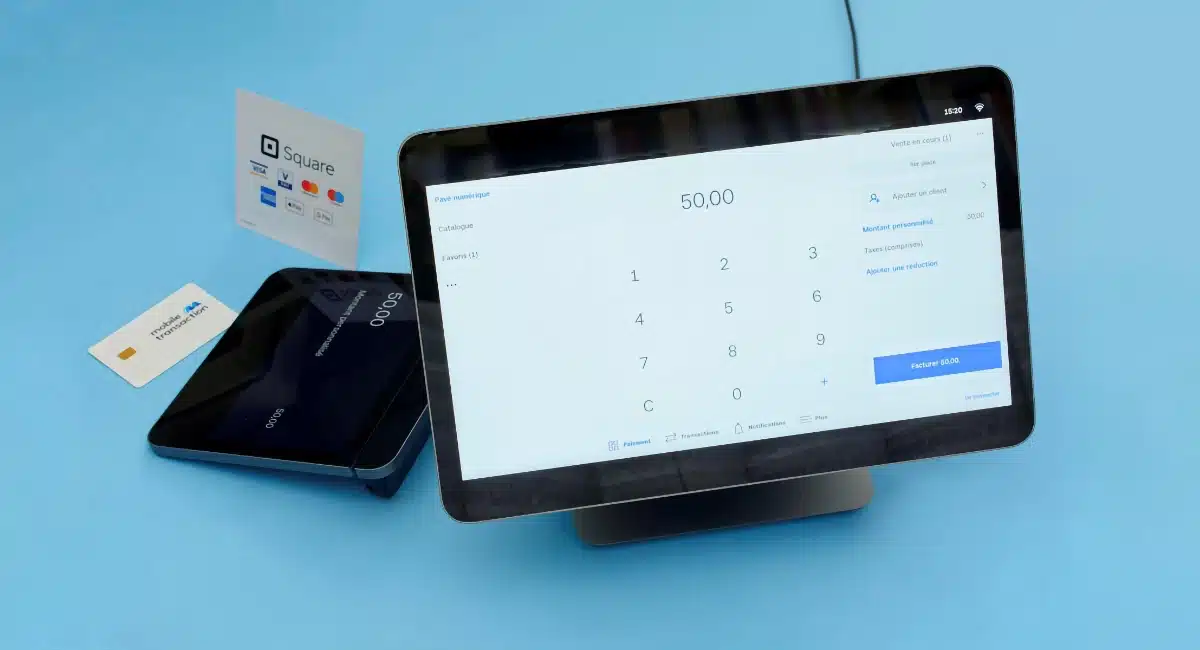

If you’re using Shopify POS in Australia, the WisePad 3 Reader from Shopify will integrate with the POS system. It connects to the POS app and works well with the Shopify Payments system.

The card reader integrates with the Shopify POS app on Android devices, iPad and iPhone.

Several receipt printers are also compatible, including models from Star Micronics. You can integrate a barcode scanner, or use the in-app barcode scanning feature made possible with the iPhone, iPad or Android camera.

If you’re selling at a counter, you can get specific cash drawers.

There’s a caveat to opening the cash drawers, though: they connect through a connected receipt printer. This means that unless you have a compatible receipt printer, the cash drawer will have to be opened manually.

Photo: Shopify

Shopify’s POS system can just be a tablet and reader, with or without a cash drawer and barcode scanner.

The compatible hardware is all pretty standard, but beware that only the particular models listed by Shopify will work. Some of it is sold online in the Shopify hardware store, but you can also buy it from any other retail stockist as long as the item is compatible.

How easy is it to get started?

Before you get started with Shopify POS, you need a Shopify account through the web sign-up form. The sign-up process takes you through the basic questions about the online shop you need and your business and personal details. The whole process takes just a couple of minutes to complete.

At the end of registration, you can skip to the service with a free trial that does not require any payment information beforehand. At this point, you can just download the POS app on your mobile device, log in with a 4-digit PIN, and start using the features.

Before you can do anything useful from the app, though, you should add products from your web dashboard. The product library applies to both your online store and POS checkout, so you don’t need to enter separate products for each.

| Shopify POS Lite | Shopify POS Pro |

|---|---|

|

POS Lite features, plus:

|

| Shopify POS Lite | Shopify POS Pro |

|---|---|

|

POS Lite features, plus:

|

Now let’s look a little closer at the point of sale features.

Inventory management

Shopify was developed for a complex online store, so all plans allow you to add unlimited products (from Backoffice) that are searchable in the POS app. With multiple locations, users can allocate stock to each brick-and-mortar store, online store, or warehouse.

In addition to a detailed product description, categories and subcategories, you can add variants such as sizes and colours. You can also organise items into collections to create some order, add pricing, quantity information alongside SKU numbers and barcodes.

Shopify will also help you track stock levels. If the stock count reaches zero, the product will not be available for sale in your online store, whereas the POS app shows quantities relevant to the location where you’re logged in.

POS Pro also gives you:

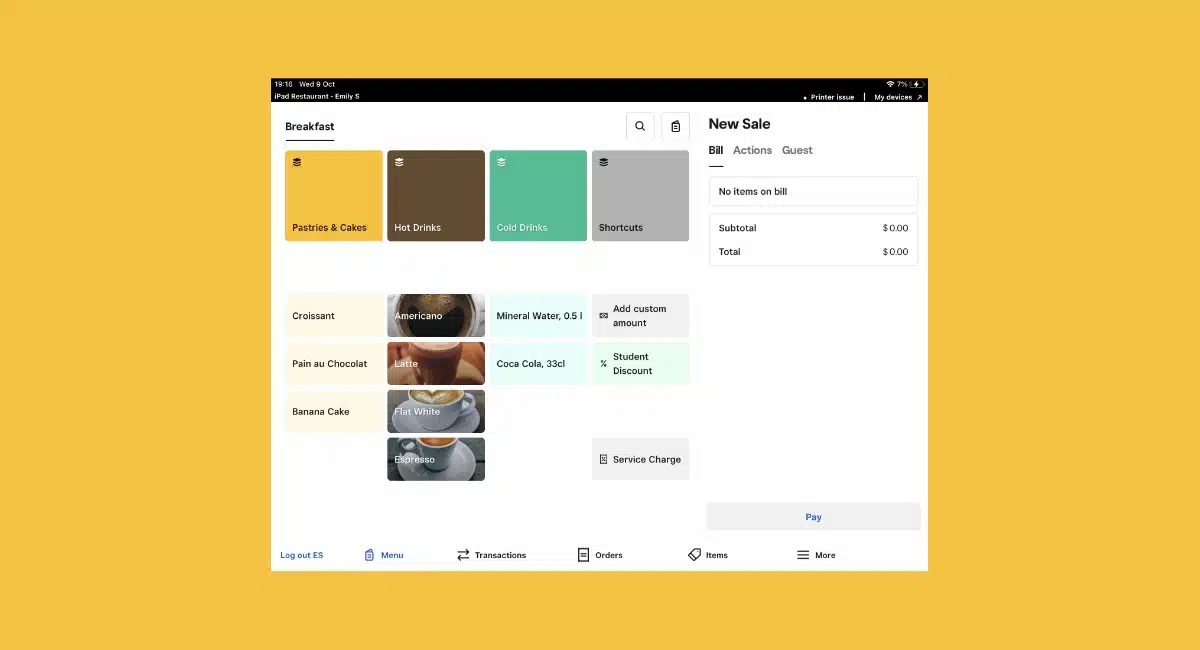

Checkout

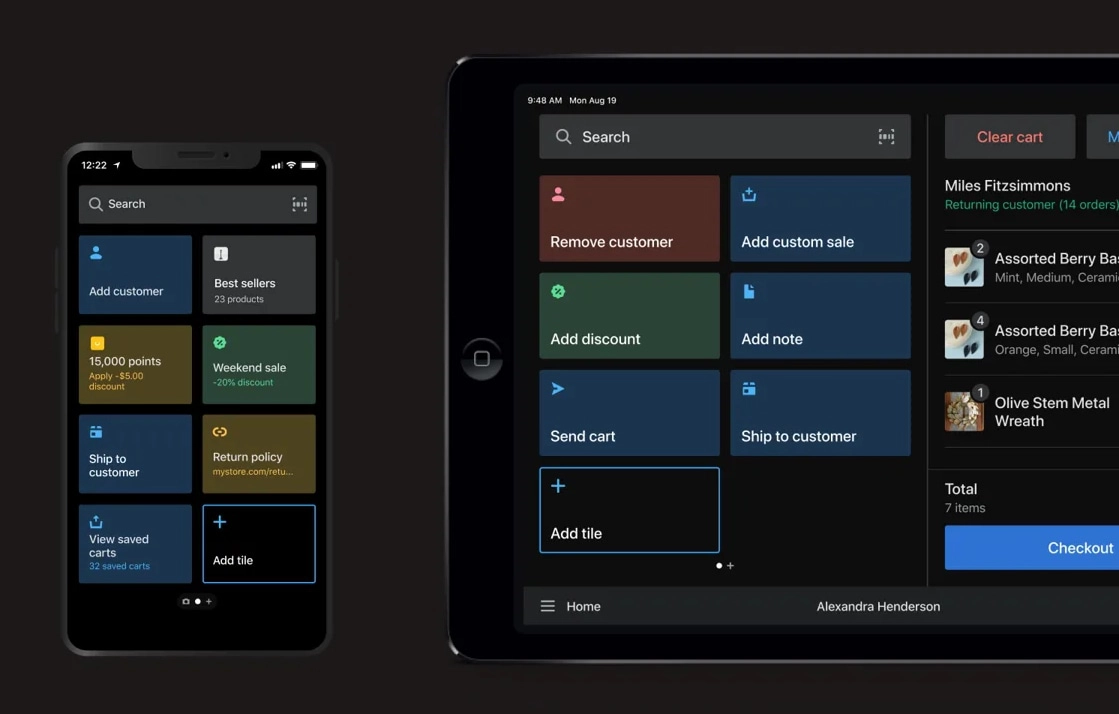

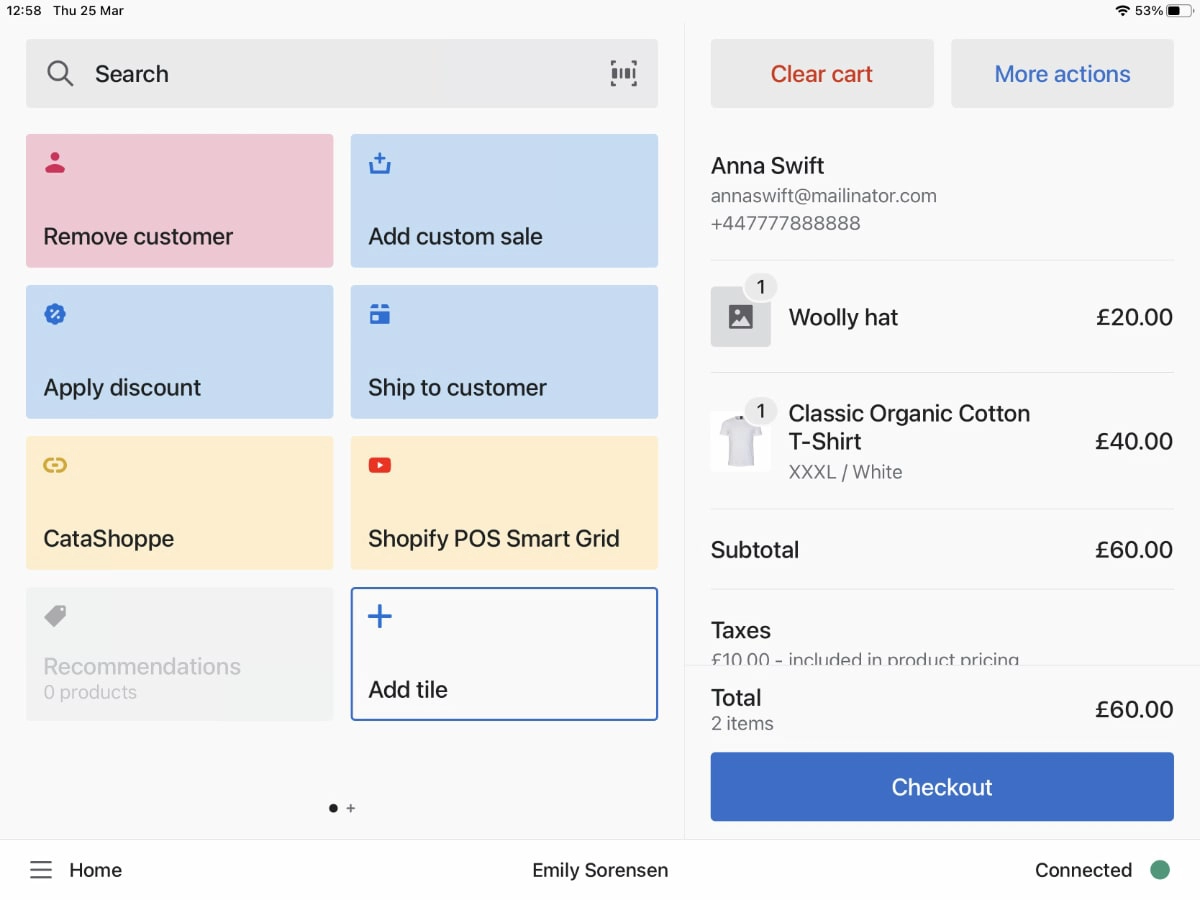

The checkout interface has a customisable ‘smart grid’ on one side of the screen to include the exact functions or products you use the most. It even adapts its buttons to show cues for staff based on cart actions – not something we’ve seen in other tablet POS.

Above the smart grid is a search bar, which you’ll probably use the most because it finds anything else such as customers, products and orders.

Credit: MobileTransaction

There is also a light colour scheme, as opposed to the black theme that Shopify promotes.

If you have a barcode scanner, scanning a product will add it to the bill, or you can use the in-app barcode scanner.

Other features include custom sales and discounts, GST calculations, discount codes, refunds (even if the item was bought online), custom email and text receipts, order notes and offline cash transactions. With a third-party app, the POS app can also show product recommendations.

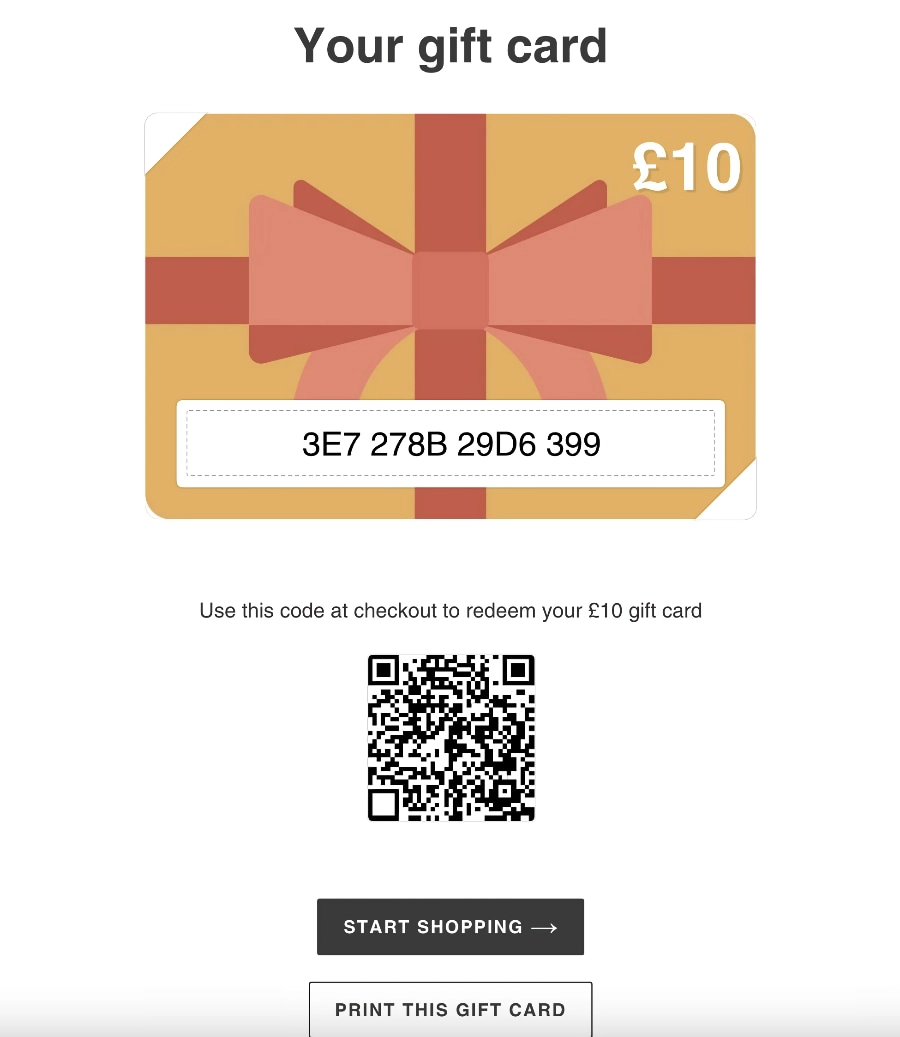

Physical gift cards can be customised and ordered online.

All plans allow you to offer and accept physical gift cards and e-gift cards emailed to customers. The physical gift cards are beautiful, but they are costly at $200-$300 AUD for a pack of 100 cards. The bigger the package, the lower the price per card.

Every transaction can be split into several payments or even saved as a partially paid transaction. You can always find an order, whether complete or incomplete, from the till app. Cash flow is tracked from the start to end of each shift.

POS Pro also gives you:

Staff management

The POS Lite plan has very limited staff functions. In fact, you can just create the maximum number of users allowed on your ecommerce plan, with PINs assigned to each team member for logging into the POS app.

POS Pro also gives you:

Customer management and marketing

All plans include the full range of customer management features.

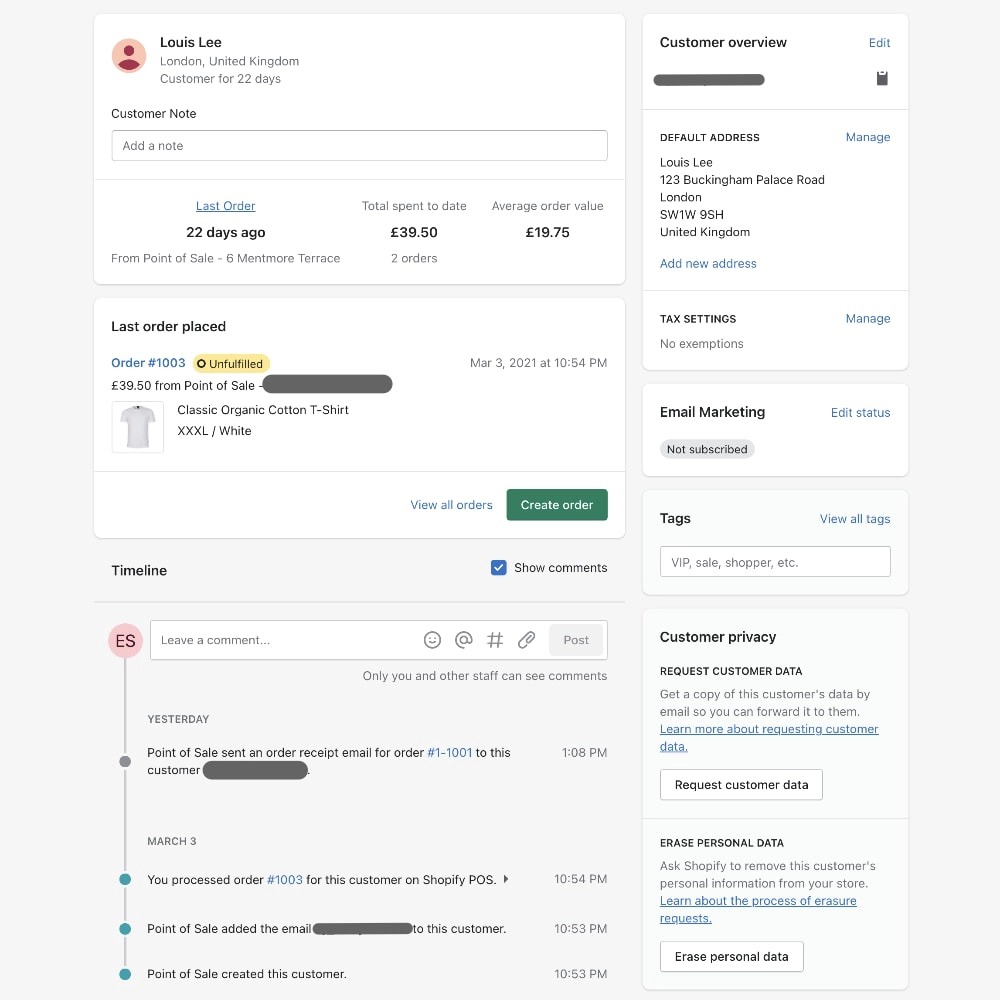

Detailed customer profiles can be created with contact information, order history, customer loyalty rewards, marketing preferences and tags. You can even reach out to customers directly from the app via text or email.

Credit: MobileTransaction

Customer profiles allow you to track their history, remove their data (on their request) and much more.

The customer profiles allow you to encourage individuals to leave a review online. If they purchase something from the online store, they can be nudged via emails to visit your shop in person, and vice versa.

You get access to all Shopify Email features on all plans, which is basically email marketing with full control over email templates, mailing lists and more. It’s pretty good value considering that other POS systems typically require external software for this.

Reports and analytics

It’s a bit of a mixed bag which reports you get on the different ecommerce and POS plans.

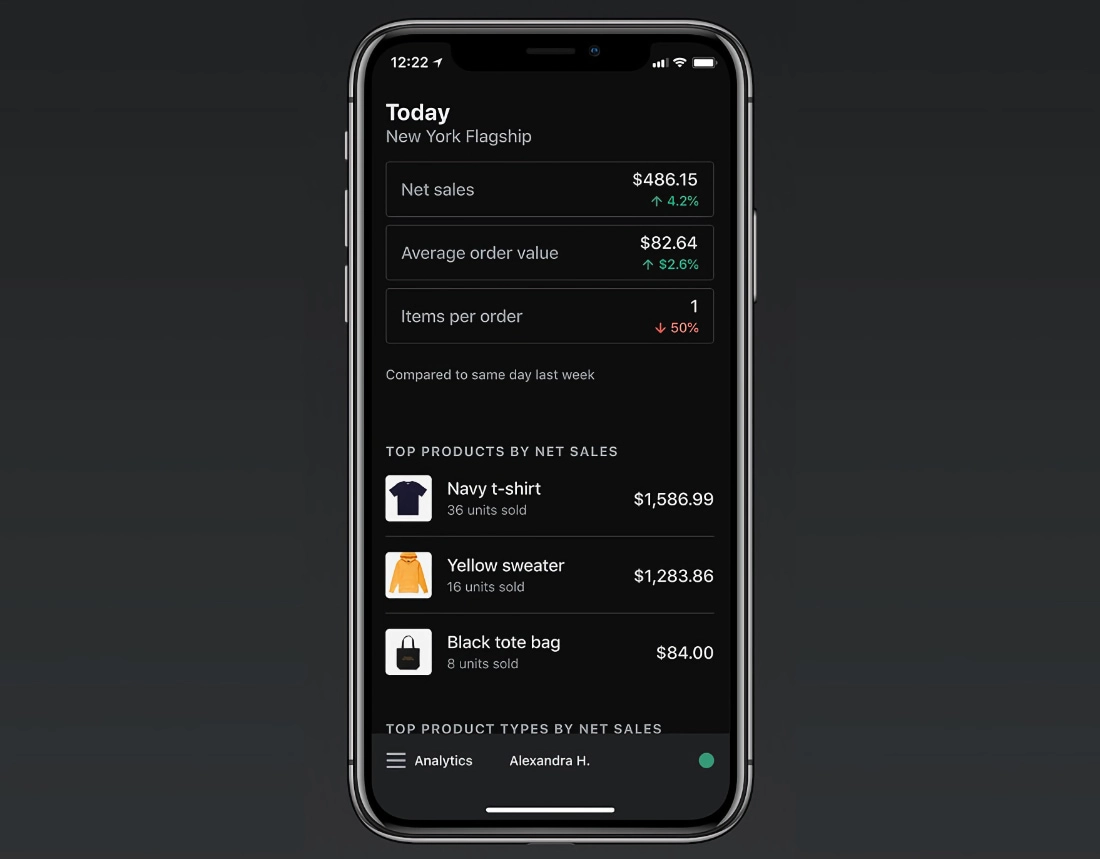

Let’s start with what everyone has access to. With all subscriptions, you can view a snapshot of transactions in the POS app or online Shopify Dashboard (there are more analytics online). The cash in your drawer is tracked – though not generated in a report – so the cash drawer can be checked against it at the end of a day. Then you have general finance and inventory reports analysing the products sold, types of payments and more.

Credit: Shopify

The Shopify POS iPhone app is convenient for checking sales remotely.

If you are on the Shopify (mid-range) ecommerce plan, you also get cash flow reports (useful when you receive the cash from your physical store), detailed product reports, discount reports and retail sales reports that help you analyse crucial aspects of your store performance.

In general, the analytics consolidate both online and in-store sales, but things like cash tracking and in-store performance are obviously specific to the physical locations. It’s also very easy to export Shopify reports to CSV files.

On POS Pro, you also get access to:

Omnichannel selling

As opposed to multichannel sales that just means you are selling through multiple channels such as an online store and POS system, omnichannel selling means different sales channels work together in an intelligent way to support the customer sales journey. This is where Shopify POS really comes into its own.

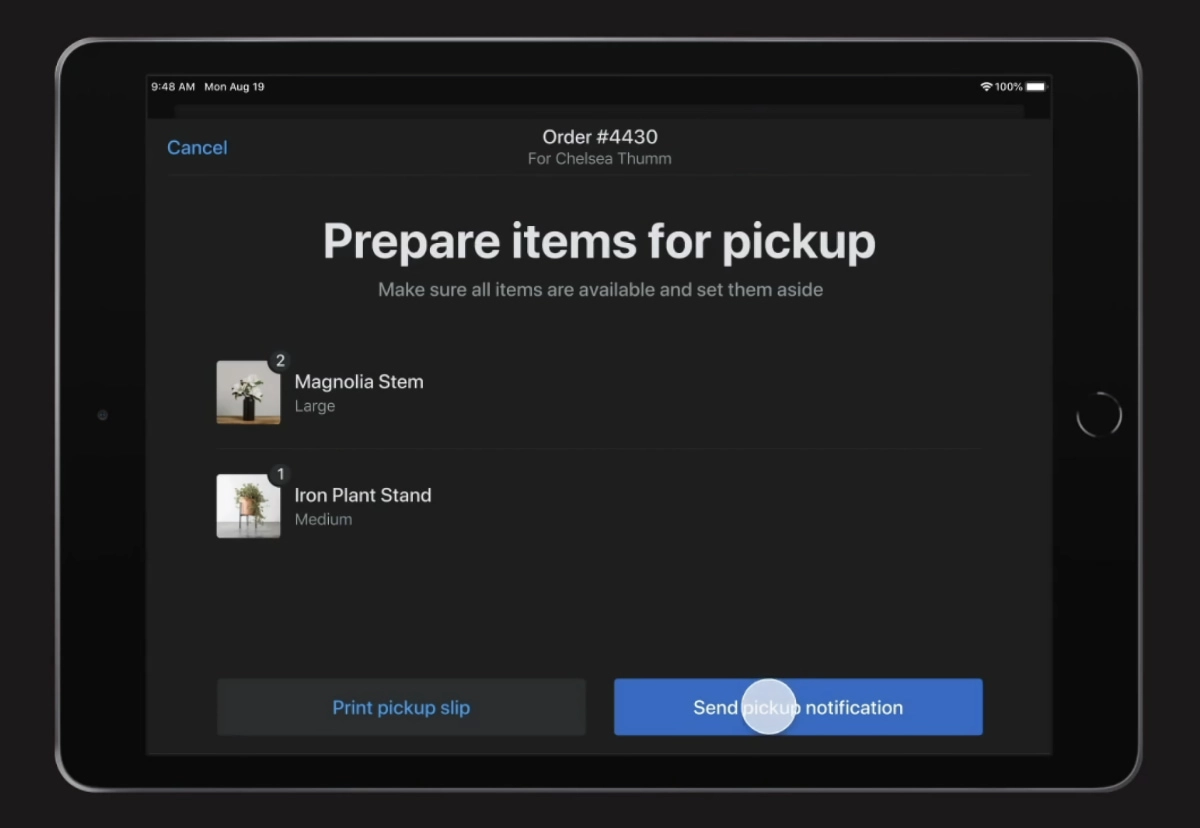

Credit: Shopify

Only on POS Pro can you organise pickup orders in the app.

You only get a few omnichannel features on POS Lite.

This includes in-store availability information on your website (locating where a product is in stock), the option to send a cart from the checkout to a customer email address so they can purchase something later online, and product QR codes that customers can scan in-store for more information.

On POS Pro, you also get access to:

Additional apps and integrations

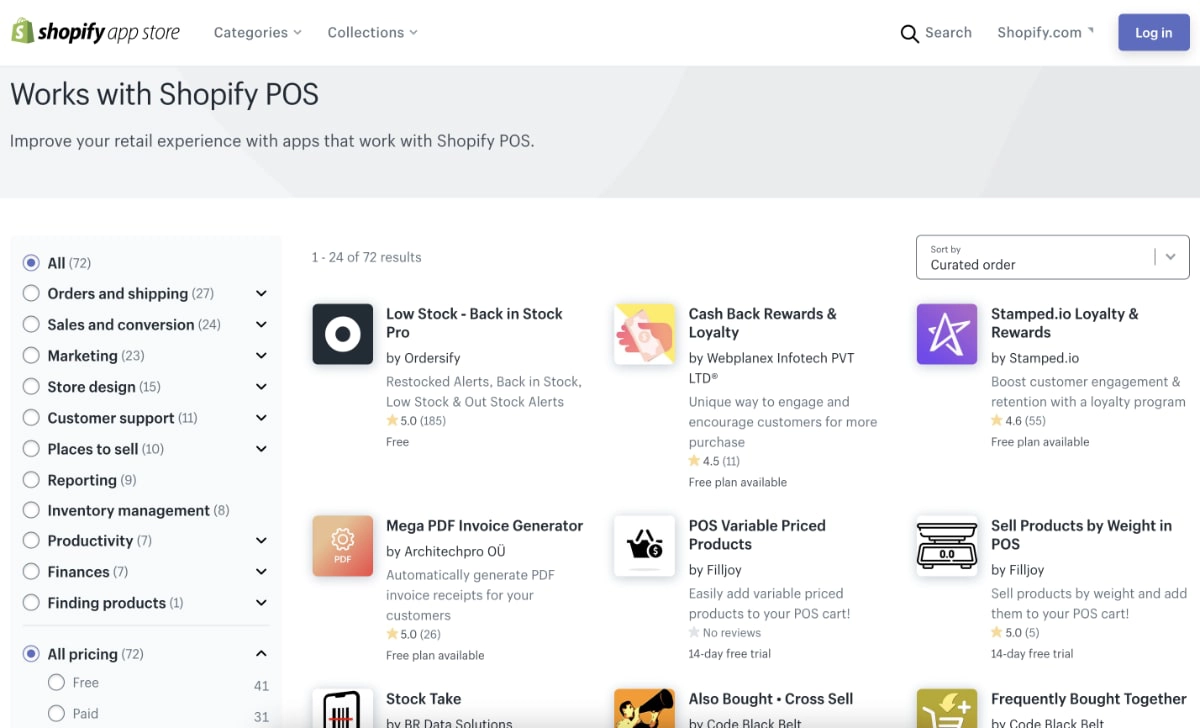

You will find an overview of all the other free and paid integrations and add-ons available in the Shopify App Store.

Amazingly, many of these apps can be added to the POS app for features such as loyalty points, items sold by weight, payroll, and inventory planning. There are 70+ apps that work with Shopify POS, and many others are geared towards the online store.

Over 70 apps from the Shopify App Store work with the POS system.

If you want to take analytics and accounting one step further, Shopify integrates with Xero and a number of other cloud accounting apps.

If your internet is intermittent, consider setting up a second WiFi connection as a backup.

For example, you can’t accept card payments offline but you can accept cash. Moreover, you can’t use customer profiles offline, so if you have a loyalty programme running, you’re going to have to throw out a lot of apologies if your internet is down.

Customer service and support

Shopify offers general 24/7 email and chat support on all plans. Round-the-clock phone support is included with a full online store plan, not on the cheap Starter plan. Priority support from Retail Support Specialists is apparently “coming soon”, which would probably only apply to POS Pro.

As for the quality of support, we’ve seen many users complain about a lack of responses from Shopify and issues not being resolved.

Our own experience is the customer service team is friendly and knowledgeable, although their knowledge about the Aussie market isn’t as strong as the standard North American service yet. We’ve seen this improve as Shopify rolled out its card reader and secured more customers, but Shopify reviews still lean towards unhelpful support.

We like that Shopify lets you know what the current wait time will be on the chat, by email or phone. The first time we emailed them, we got a reply within six hours. Our second time emailing, we were told the average response time was 14 hours – we got a response 21 hours later.

The bottom line is that Shopify works well as a product, but dealing with issues can get difficult.

Recent users have reported regular server issues on the ecommerce side, but we see that the POS app is regularly updated to address bugs and improve features. Another common complaint is the need to reactivate (i.e. pay for a subscription) an inactive Shopify account in order to deactivate it.

The bottom line is that Shopify works well as a product, but dealing with issues can get difficult.

Who is it best for?

Shopify POS is created for brick-and-mortar retail businesses that also sell online. Even if your store is based in Australia, we like the fact you can cater to international customers by accepting a different currency to Australian dollars.

If you’re running a restaurant, bar or coffee shop, other POS systems would definitely suit you better because it doesn’t really have hospitality functions.

Instead, Shopify is particularly suited to complex product management and those with multiple locations who sell across multiple channels.

Shopify targets small-to-medium businesses, but they also cater to enterprises with their Plus plan.