- Pros: Clever POS-ecommerce integration. Good quality hardware. 24/7 customer support.

- Cons: Requires ecommerce subscription. High transaction fee on cheap plan. Slow payouts. Poor customer service reviews.

- Best for: Retailers selling online primarily and want to link up an EFTPOS terminal.

Contents

In summary

How it works

Our opinion

In detail

Pricing

Card reader and hardware

POS features

Service and reviews

The team at MobileTransaction has personally tested WisePad 3 Reader for an honest review of the product. Photos and opinions are our own.

Accepted cards

There are two versions of the POS software: POS Lite and POS Pro. The free Lite plan is suitable for basic retail shops while the paid (in addition to an ecommerce plan) POS Pro is built to enhance the customer experience, coordinate online and in-store sales and manage a larger inventory library.

Although anyone can buy the card reader, it only works when you’re on one of Shopify’s ecommerce subscriptions.

If you’re only accepting cards in person, the cheapest online subscription is Starter ($7 AUD/month) that has tools for selling on social media.

The card reader really comes into its own with a full-fledged Shopify online store, since all payments, customer data and inventory are synced in the cloud for seamless multichannel sales.

Photo: MobileTransaction

The card reader comes in a recyclable cardboard box.

Our opinion: good for Australia, but only with ecommerce

Given the compulsory ecommerce subscription, it’s only worth getting the Shopify card reader if you’re planning to sell online too. We don’t think it has any advantages as a standalone point of sale solution – we’ve tested other EFTPOS machines in Australia that would.

You also have to accept the fact that payouts can take about a week – a long time for micro-businesses where a quick cash flow is important.

| Shopify card reader criteria | Rating | Conclusion |

|---|---|---|

| Product | 3.9 | Good |

| Costs and fees | 3.4 | Passable/Good |

| Transparency and sign-up | 3.8 | Good |

| Value-added services | 4 | Good |

| Service and reviews | 3.2 | Passable |

| Contract | 4 | Good |

| OVERALL SCORE | 3.7 | Passable/Good |

Compared with other retail POS systems, Shopify POS Pro makes it easier for retailers to switch between online ordering and in-store pickup. All the customer communications are integrated in the same platform, and that saves time for a retail shop.

“WisePad 3 Reader is an excellent product for its target audience: Shopify sellers who want to link online with in-store sales. I like the design of the reader, and it works smoothly.”

– Adriana Capasso, Senior Editor of MobileTransaction Italy

EFTPOS alternatives on the market may not have a similarly smart integration with an online store (Square mostly does), but most can integrate with ecommerce software.

As for the hardware, we think WisePad 3 Reader is a fairly good quality, reliable card reader with no real issues. But there’s nothing spectacular about it except for its pocket-sized convenience.

All things considered, Shopify’s card reader only makes sense if you’re into the Shopify POS system, which only makes sense with a long-term Shopify online store. The transaction fees and monthly costs are just too high otherwise.

Pros

Cons

Shopify pricing

To use the Shopify card reader, you need to buy it upfront for A$79 + GST and choose any of Shopify’s paid ecommerce subscriptions. New sign-ups get a 14-day free trial. The card reader comes with a standard year’s warranty (or two years on a POS Pro plan) and 30-day money-back guarantee if you change your mind within a month.

There’s no contractual commitment for these subscriptions in Australia, but paying annually upfront reduces the monthly cost compared to a monthly plan.

| Costs* | |

|---|---|

| Shopify WisePad 3 Reader | $79 |

| Shipping | Free |

| Shopify Starter subscription | $7/mo (monthly plan) |

| Basic Shopify subscription | $56/mo (monthly plan) $504/yr (annual plan) |

| Shopify subscription | $149/mo (monthly plan) $1,368/yr (annual plan) |

| Advanced Shopify subscription | $575/mo (monthly plan) $5,172/yr (annual plan) |

| POS app | Shopify POS Lite: Free Shopify POS Pro: $129/mo per location |

| Commitment | Cancel any time, but fees non-refundable |

*Pricing in AUD. GST is added to the prices.

Shopify Starter is the cheapest at $7 monthly. It includes online selling features, but no full-fledged online store. The monthly online store plans are Basic Shopify for $56/month, Shopify for $149/month and Advanced Shopify for $575/month, excluding GST which is added at checkout.

On top of this, you can choose to subscribe to Shopify POS Pro ($129 per month per location) that includes all of Shopify’s POS system features in the iPad app. This subscription only has a monthly price plan. If you don’t need all the features, it’s perfectly okay to just use the Shopify POS Lite features included free in the app.

The transaction fee for payments through the card reader depends on the plan: it’s 5% on Starter, 1.95% on Basic Shopify, 1.85% on Shopify and 1.75% on Advanced Shopify subscriptions. Online transaction fees are also lower on the pricier plans (table below).

| Card reader transactions* |

Online transactions* |

|

|---|---|---|

| Shopify Starter | 5% | 5% + 30¢ |

| Basic Shopify | 1.95% | 1.75% + 30¢ |

| Shopify | 1.85% | 1.6% + 30¢ |

| Advanced Shopify | 1.75% | 1.4% + 30¢ |

| Refunds | Original transaction fee retained | Original transaction fee retained |

| Chargebacks | $25 | |

*Pricing in AUD.

Transactions through Shopify Payments usually settle in your Australian bank account within 5 business days, which is not fast. There are no charges for these automatic payouts.

There’s a $25 chargeback fee if a customer disputes a transaction, which is non-refundable unless the dispute is resolved in your favour. If a refund is processed, Shopify will charge the original transaction fee for it.

Card reader and hardware

Shopify sells three card machines in Australia:

- Shopify POS Terminal (A$379 + GST) – countertop card terminal with customer-facing display, requires tablet with POS app

- Shopify POS Go (A$349 + GST) – portable, all-in-one POS interface, barcode scanner and card reader

- Shopify WisePad 3 Reader (A$69 + GST) – card reader with push-buttons, requires mobile device with POS app

We’re focusing on WisePad 3 Reader – manufactured by BBPOS – since it is the most popular model and we have tested it.

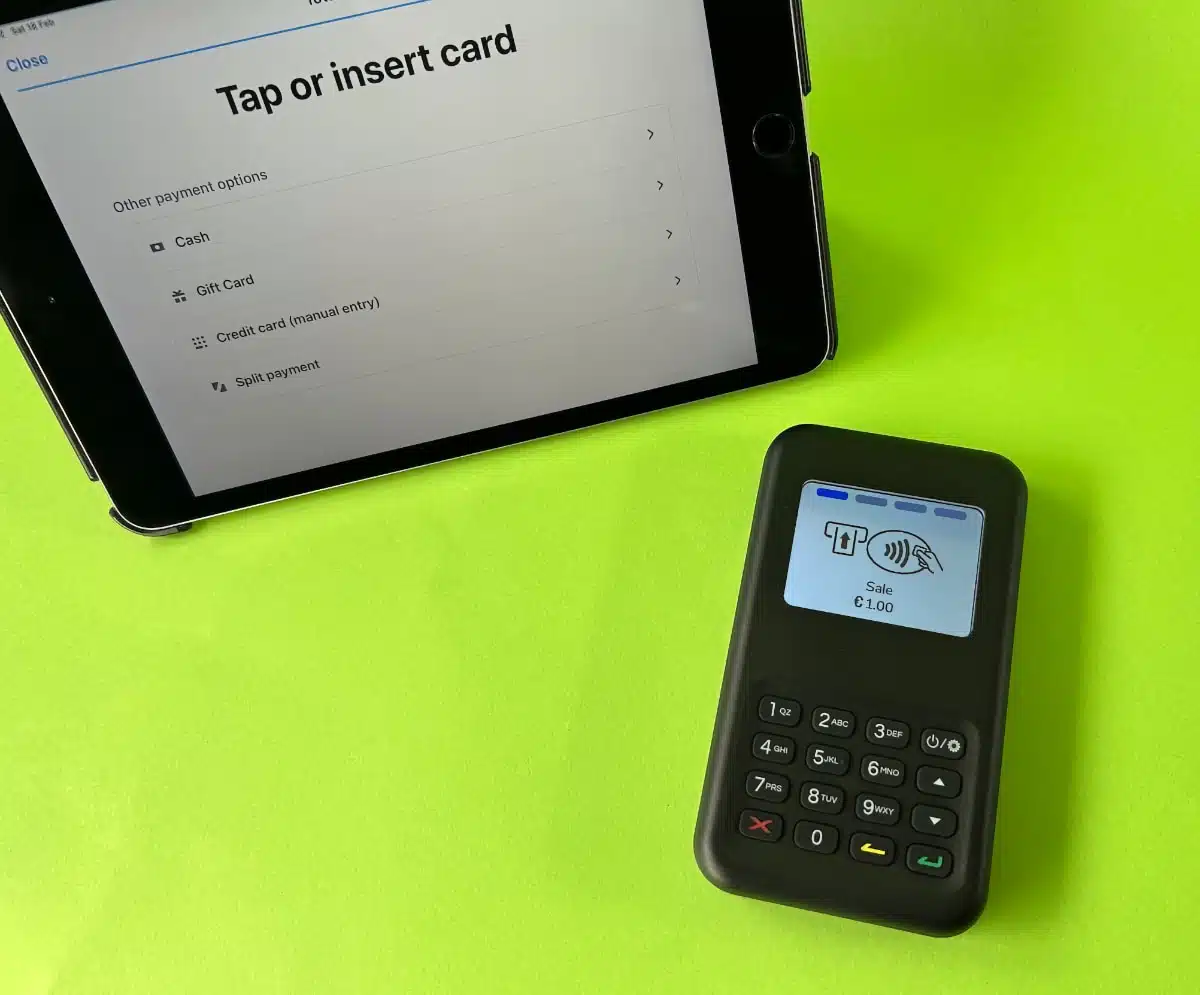

The card reader accepts contactless (NFC) and chip and PIN cards, but only in conjunction with the iOS or Android Shopify POS app. It connects with an iPhone, iPad or Android smartphone or tablet over Bluetooth, then uses the mobile device’s WiFi or mobile network to process payments over the internet.

Photo: MobileTransaction

WisePad 3 Reader syncs with the iPad POS app.

The card terminal weighs 130 grams and measures 122 mm (H) x 70 mm (W) x 18 mm (D), so it is quite small and lightweight. No receipt printer is built in, but it has a physical PIN pad.

“It’s increasingly rare to see cheap card readers with a physical button PIN pad, so we liked that as a stand-out feature for an otherwise plain-looking device. Ergonomically, this is a better, more accessible design than many touchscreen card readers.”

– Emily Sorensen, Senior Editor, MobileTransaction

Photo: MobileTransaction

The reader accepts chip and PIN.

Photo: MobileTransaction

WisePad 3 is very compact.

The card reader can be purchased on its own or with an iPad stand. The POS system is also compatible with till drawers, receipt printers and a barcode scanner – all available from the Shopify hardware store.

It’s possible to use an external card machine from another payment provider, but then the terminal isn’t integrated with the POS software. Instead, you manually have to confirm in the Shopify POS app when the card payment has gone through the external credit card processor.

We found the card reader easy to use and reliable in our tests, but design-wise not as interesting as the comparable card readers of Square and SumUp.

POS features

All ecommerce subscriptions include basic point of sale features – Shopify POS Lite – that are enough for a small shop, market stall holders, pop-ups and mobile merchants. If you trade from more than one location and require more inventory management and checkout features, Shopify POS Pro is better.

“I had to get used to Shopify POS’s software, since it doesn’t have a standard layout. It’s more sophisticated than just a product menu with a checkout process – it does away with superfluous buttons and lets you process online orders in store. Very impressed with it.”

– Emiy Sorensen, Senior Editor, MobileTransaction

Shopify POS is designed for retailers selling online, who require a POS system that connects in-store sales with online orders – but you only really benefit from this on the Pro plan.

With Lite, you can:

Payments: Accept cards, cash, custom payment types and gift cards. Sell physical or digital digital gift cards (only with Basic Shopify, though). Split the tender, accept deposits/partial payments and do layaways. The till records cash flow so you can always track how much you’re meant to have in the till drawer.

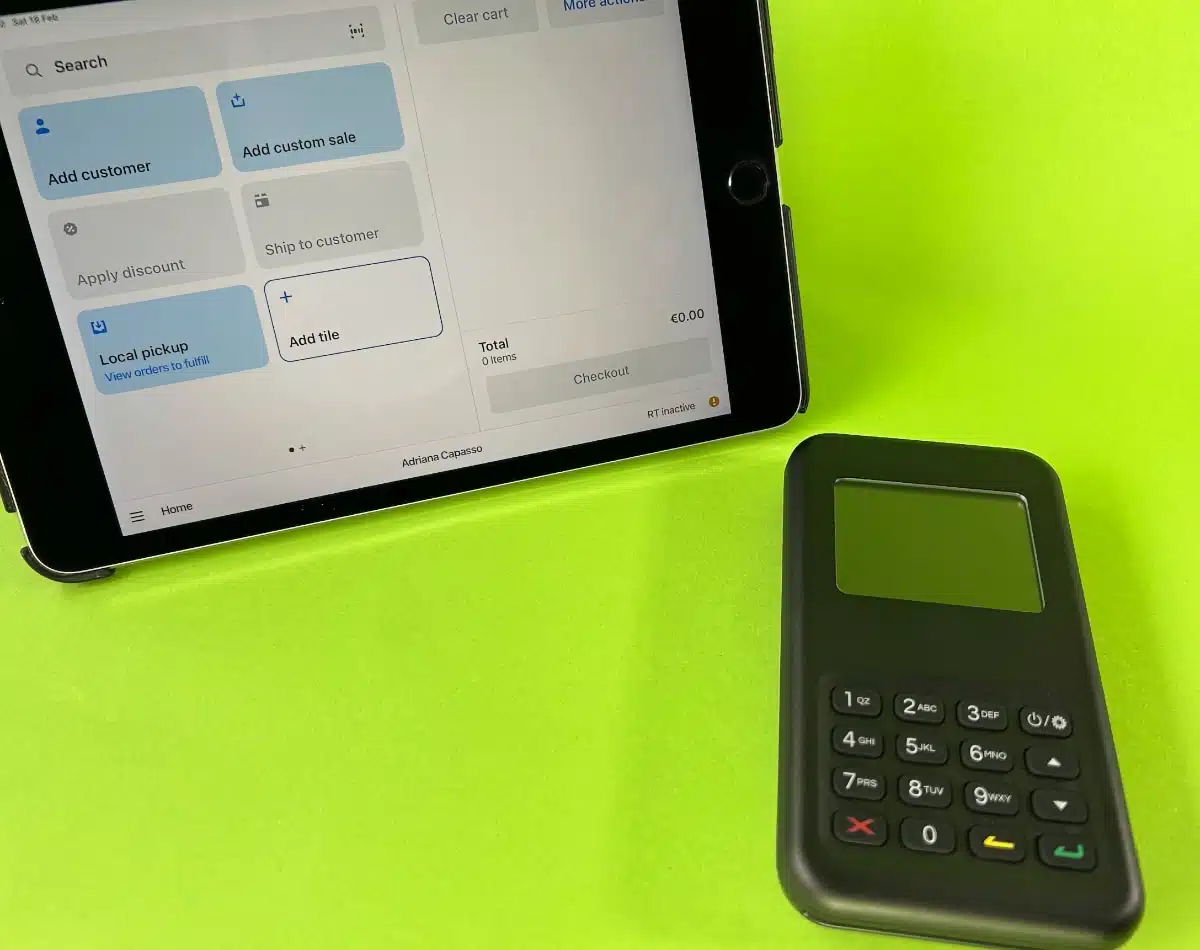

Checkout: The till interface is a customisable ‘smart grid’ with buttons for important functions like discounts, inventory and apps. You can easily search customers, products and orders, accept tips, do refunds (exchanges only on Pro), add products or custom amounts to the bill, and customise discounts if not using preset discounts. Staff can get their own PINs for the till.

Online integration: Print QR codes to attach to products in store so customers can scan it for information or buy online without asking staff. In the online shop, people can see in-store availability, but it requires Pro to order for collection. Customers browsing in person can get email reminders for purchasing their favourite items online.

Photo: MobileTransaction

The Shopify POS app works very well with WisePad 3.

Products: Add unlimited products, variants and product collections. Products can be assigned to different locations (e.g. online, in store, warehouse) and tracked as you can see inventory statuses (e.g. received, transferred, order fulfilment).

Customers: Build relationships through customer profiles where transactions, notes, tags and contact details are saved. You can offer exclusive discounts, events and content through emails, if they have opted in for marketing emails.

Reports and analytics: There are more than a few reports to analyse sales, products sold, discounts given, cash flow and more. You can, however, only get a comprehensive daily sales report on the Pro plan.

On Shopify POS Pro, you get a more sophisticated integration of online-offline features, for instance online ordering for in-store collection or delivery. If customers buy something online, they can return it in person. The checkout gives personalised recommendations based on customers’ online purchases. You can also customise receipts and save carts to serve multiple people at once. Inventory and staff management are much more advanced on Pro.

Customer support and reviews

Shopify subscribers get 24/7 customer support via email and live chat. There is also an online help centre with in-depth answers to most queries.

We’ve seen quite a lot of complaints about the quality of service, where issues do not get resolved or Shopify doesn’t respond to basic queries (if you get through to them in the first place).

Many users have had their online store closed or products taken off the site due to Shopify’s security procedures. This has resulted in merchants having a hard time recovering transactions they were meant to receive.

Some have been locked out of their accounts, thereby losing the ability to contact support, remove an online store or delete credit card details.

Cancelling a Shopify membership also appears to be difficult despite the lack of contractual commitment.

There are also users who are quite happy with Shopify’s online store system. Our own tests have found it to be a comprehensive ecommerce platform that is generally easy to figure out for a non-coder.

Few reviews actually talk about the POS system and card reader, as those are more of a secondary offering in addition to the ecommerce features.

When we tested the POS app, it was user-friendly and looked simpler than expected. But once you take full advantage of the customisation options and Pro features (if paying for it), it becomes quite sophisticated.