Overview

In brief

What is it?

Our opinion

In detail

Card machines

Pricing

Merchant portal

Online payments

Service and reviews

Alternatives

Getting started

What is PayNuts?

Launched in February 2023, PayNuts offers modern, touchscreen EFTPOS machines and online payments for small and medium businesses in Australia. The company used to operate as More Payments (now discontinued), but rebranded as PayNuts.

The company handles card payment processing and next-day payouts to your business bank account (PayNuts doesn’t offer its own business account). The range of accepted payment schemes is quite good considering it’s a new solution on the market.

Accepted cards

As a merchant service provider, PayNuts aims to be the antidote to bureaucratic EFTPOS providers requiring lock-in and lengthy application processes. Instead, users get an easy application process to rent the latest EFTPOS machines on a no- or low-cost plan with very affordable rates for a small business.

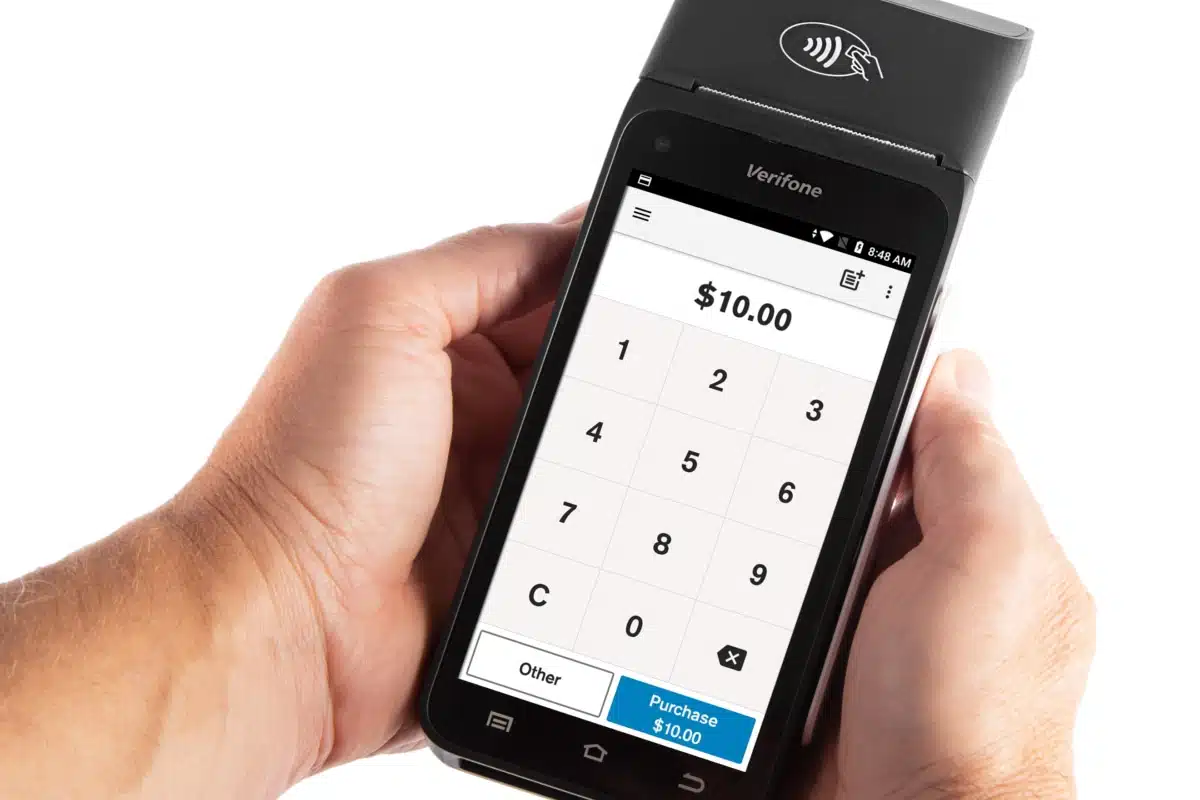

Photo: PayNuts

The central product of PayNuts is its EFTPOS machine.

Our opinion: one of the best alternatives to a bank

Compared with other EFTPOS solutions in Australia, PayNuts shows pretty good potential. It offers a plan for those who want to avoid any charges and competitive pricing for those who’d rather spare their customers from an extra fee (surcharge).

To avoid monthly fees on the No Fee plan, however, a minimum turnover per terminal is required, so it might not suit low-volume businesses. Still, we really like the EFTPOS machine selection, simplified and fair fees, and very accessible 24/7 support.

| PayNuts criteria | Rating | Conclusion |

|---|---|---|

| Product | 4.4 | Good/Excellent |

| Costs and fees | 4 | Good |

| Transparency and sign-up | 3.8 | Good |

| Value-added services | 3.8 | Good |

| Service and reviews | 4.2 | Good |

| Contract | 4.9 | Excellent |

| OVERALL SCORE | 4.1 | Good |

The quality of the EFTPOS machines is ace, and you won’t struggle to find a POS system that integrates with them. The PAX and Verifone terminals are high-performing and future-proofed with functions like barcode scanning and clear touchscreen displays.

“We’ve had a very positive experience of the service and motivations of PayNuts in our dealings with them. Importantly, they’ve chosen good-quality EFTPOS machines and fair pricing we can get behind.”

– Emily Sorensen, Senior Editor, MobileTransaction

Although great that online payment payments are available, there’s still no accounting integration, and the online resources could do with more detailed how-to guides.

The fully digitised onboarding process, attention to merchants and lack of bureaucracy are positive signs that PayNuts prioritises businesses, though.

EFTPOS machines

PayNuts offers three EFTPOS machines: the portable and mobile Verifone T650p, PAX A910S and PAX A77 smart POS terminals.

They all connect to the internet via WiFi, Bluetooth (within reach of a router) or the local 4G network through a complimentary SIM card with unlimited data. They also have crisp-clear HD touchscreens and powerful battery lives.

And the differences? PAX A910S and Verifone T650p have a receipt printer built in, while PAX A77 doesn’t. In fact, the A77 is compact like a smartphone, yet boasts a 5.5″ colour touchscreen like T650p.

PayNuts’ recommended terminal, PAX A910S.

PAX A77 is small and without a printer.

PAX A910S’s screen is smaller at 5″, but the terminal has the fastest-charging battery and processes payments faster. Since this model was launched, PayNuts advertises it as “best in class”, but I’d say the Verifone T650p is really not far behind (it’s usually also called “best in class”).

Photo: PayNuts/Verifone

Verifone T650p (pictured) is slightly slower than PAX A910S, but still very good.

Designed for versatility and accessibility, all the terminals are Android-based and have an app where you enter a transaction amount before giving it to the payer for a contactless, swipe or chip card payment. They also have scanners for barcodes and QR codes.

“I’d say both A910S and T650p can be called “best in class” with their similar features, but PAX A910S is faster and longer-lasting. Go with A77 if you want a small, mobile card machine for your pocket and don’t need to print receipts.”

– Emily Sorensen, Senior Editor, MobileTransaction

The devices are very user-friendly with the capacity to accept tips, send digital receipts (or print if available), and display sales or settlement totals. More complex POS features require an integration with a full-fledged POS system.

All the terminals integrate with over 700 different POS and business software systems for retail, hospitality, hotels and most other merchant sectors. This makes PayNuts quite adaptable and ready for when your business grows in complexity.

Pricing

PayNuts tries to keep EFTPOS fees and subscriptions as simple as possible. Regardless of the chosen package, there are no fees for setting up and no contractual commitment. You can cancel any time without a termination charge.

Settlement of funds the following business day is free. Same-day deposits are available for an additional fee disclosed when asking about it.

| General PayNuts EFTPOS fees | |

|---|---|

| Setup fee | None |

| Contract | Cancellable any time |

| Settlement | Next-day: Free Same-day: Fee applies |

| SIM card for terminal | Free; unlimited data included |

| Exit fee | None |

| General PayNuts EFTPOS fees |

|

|---|---|

| Setup fee | None |

| Contract | Cancellable any time |

| Settlement | Next-day: Free Same-day: Fee applies |

| SIM card for terminal | Free; unlimited data included |

| Exit fee | None |

Apart from that, there’s a choice between two EFTPOS plans with different charges: Pay Nothing EFTPOS or Low Fee EFTPOS. Both include a card machine with a built-in SIM card with free, unlimited data.

On the Pay Nothing plan, transaction charges are all passed on to customers through a variable surcharge. If your monthly sales volume per card machine is below $10,000, you pay $29 (incl. GST) that month for card machine rental. When sales exceed $10k during a month, there is no cost that month.

No additional charges apply on the Pay Nothing plan – including for chargebacks, American Express, receipt paper rolls, remote payments or call-out repairs. You truly pay nothing, except for the monthly cost below the minimum $10k sales volume.

| PayNuts Pay Nothing EFTPOS fees | |

|---|---|

| Monthly fee | Sales/month below $10k: $29 incl. GST $10k+ sales/month: Free |

| Transaction fees | None – passed on to cardholder as a surcharge |

| Refunds | Free |

| Chargebacks | Free |

| Receipt paper rolls | Free |

| PayNuts Pay Nothing EFTPOS fees |

|

|---|---|

| Monthly fee | Sales/month below $10k: $29 incl. GST $10k+ sales/month: Free |

| Transaction fees | None – passed on to cardholder as a surcharge |

| Refunds | Free |

| Chargebacks | Free |

| Receipt paper rolls | Free |

The Low Fee plan, in contrast, always charges $29 (incl. GST) per month for terminal rental, regardless of sales volume processed.

What you get instead are fully tailored, competitive (“low fee”) charges based on your type of business and revenue. These could span between 0.8%–1.5% for a small business, depending on the type of card. Amex costs more to process, as do other international, premium credit cards. Paying for transactions yourself means you entirely avoid awkward situations with customers who don’t want to pay a surcharge.

Then there are costs for chargebacks, receipt rolls and other one-off or ongoing things applicable to your usage. These are all outlined in writing during onboarding so there are no surprises down the line.

| PayNuts Low Fee EFTPOS fees | |

|---|---|

| Monthly cost | $29 incl. GST |

| Transaction fees | Custom rates depending on revenue, business and card accepted |

| Other | Misc. tailored fees |

| PayNuts Low Fee EFTPOS fees |

|

|---|---|

| Monthly cost | $29 incl. GST |

| Transaction fees | Custom rates depending on revenue, business and card accepted |

| Other | Misc. tailored fees |

Alternatively, you can use PayNuts as a short-term rental solution through the Event EFTPOS package. Costs for that are also tailored to your situation.

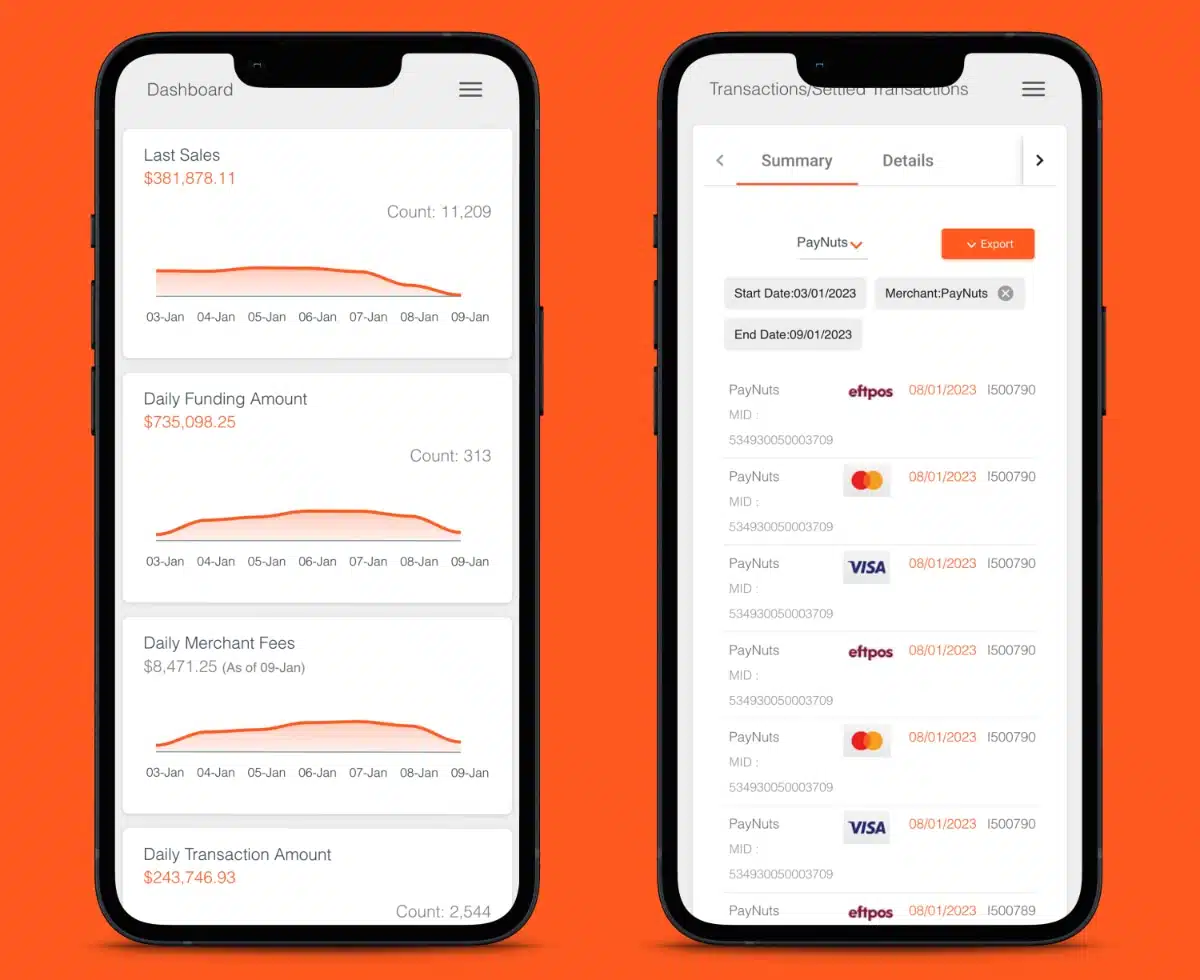

You can view a summary of figures on the Merchant Portal’s dashboard page.

On the dashboard (home screen), daily, weekly and monthly sales, fees, deposits and more key figures are illustrated in graphs for a quick overview. You can generate and export detailed reports for transactions, funding deposits and more from sub-sections of the portal.

As of yet, you can’t integrate the system with accounting software, but exporting the sales data allows you to feed it into your bookkeeping system of choice.

Detailed information about deposits is viewable in the PayNuts app.

Online payments

PayNuts doesn’t just offer EFTPOS packages, the company offers online payments too. You can get:

- Hosted online payment gateway (checkout) for your website – free

- Payment links to send via email or SMS – $5 per month

- Virtual terminal for merchant-entered, remote transactions – free

The online transaction fees are based on your business and whether they’re passed on to the customer’s bill. Funds are received the following working day, which is much faster than e.g. Stripe.

PayNuts accepts a wide selection on payment methods online, including:

- Cards: eftpos, Visa, Mastercard, Amex, UnionPay

- Digital wallets: Apple Pay, Google Pay, Alipay, WeChat Pay

- Buy now, pay later: Afterpay, ZipPay

The payment gateway integrates out-of-box (via a plugin) with online stores built in WordPress, WooCommerce, OpenCart, Adobe Commerce (previously Magento) or PrestaShop. It’s possible to integrate with other website platforms or mobile apps, but you may need a developer to program it with the given APIs.

Those who just need a way to accept cards over the phone or via mail order can just use the virtual terminal. This is a web page where merchants can manually enter the card details of the customer and complete the transaction remotely.

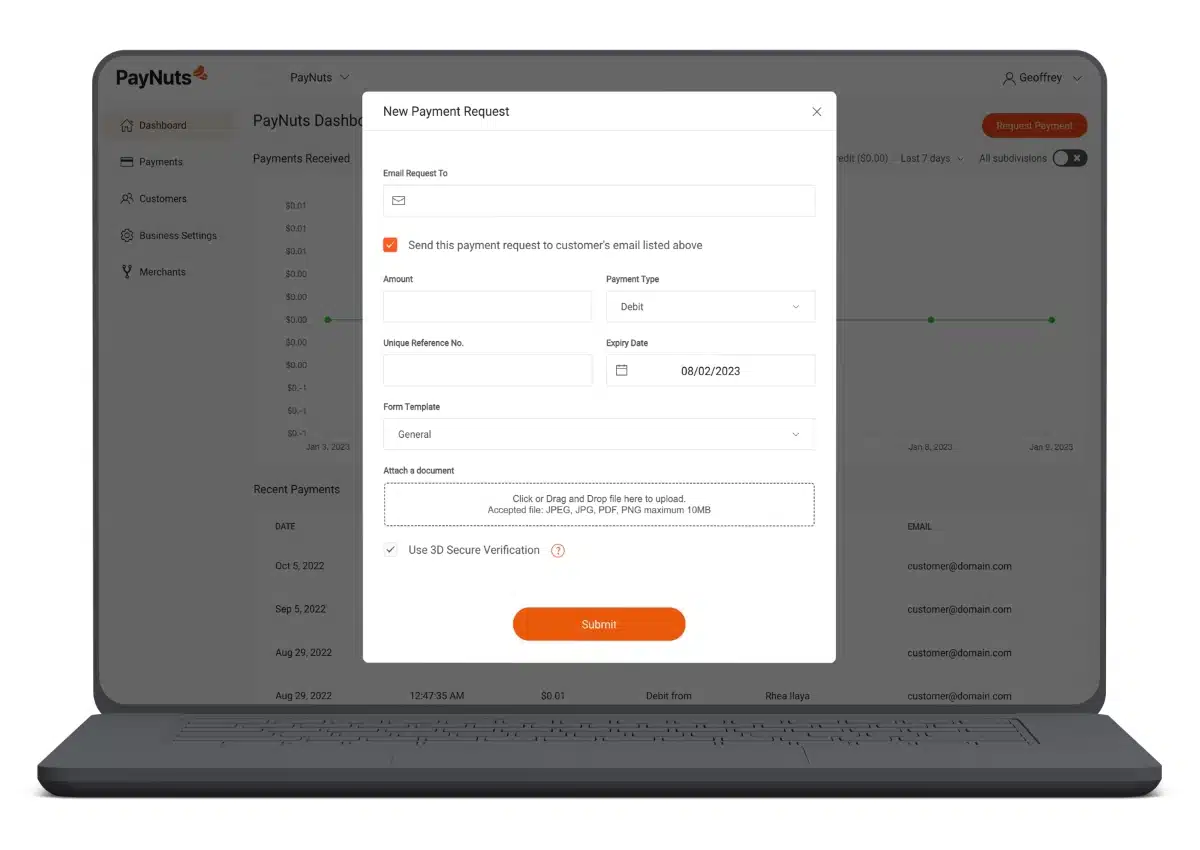

Photo: PayNuts

You can send payment requests online from the Merchant Portal.

Payment links are an easy way to request payments remotely. After clicking the link, the customer will see your branded checkout page with the amount to pay, including the surcharge if your business opts for this. Both the merchant and customer receive a confirmation following each successful payment.

Only the payment links have a monthly fee of $5 which is cancellable any time; the other tools incur no monthly charge.

Customer support and reviews

All PayNuts merchants can access 24/7 customer support via email, telephone and messaging chat, which is more accessible than competing players in Australia. There is also an online help section for common questions, but no substantial step-by-step guides.

Because it’s a brand new solution, there are virtually no impartial user reviews for PayNuts specifically. You can only find More Payments (previous branding) reviews with generally high ratings citing excellent customer service and a smooth application process.

PayNuts compared with alternatives

The competitors most similar to PayNuts are Smartpay and Tyro They both have “no-fee”, rental-free plans for businesses transacting for over $10k per month just like PayNuts.

We rate PayNuts higher, because Smartpay has a hidden condition where you pay to leave the contract within a year, and Tyro has a track record of a slow service.

If you’re looking for no monthly fees and no complexity at all, the best PayNuts alternatives are Zeller and Square. Merchants buy their card machines upfront and pay only a fixed fee for transactions as needed. They also have many extra features like online payments and fast funds transfers.

The major banks in Australia have become better in the last few years when it comes to their EFTPOS offering.

CommBank, Westpac and NAB no longer have long contracts or complex pricing, and their EFTPOS machines have been updated. But they are still bureaucratic banks that take longer to onboard and help businesses than PayNuts.

Getting started

To sign up, you complete a short online form with details about yourself, the business and products you’re interested in. This gets sent to the onboarding team who will phone you with a tailored quote and/or email a digital application that takes a few minutes to complete online.

You do have to submit digital copies of a few required documents, including:

- Passport or driver’s licence

- Proof of bank account

- Proof of trading address

A bank account at any Australian bank, matching the name of your business, is a strict requirement.

We know from our own communications with PayNuts that it’s a friendly team that prioritises efficient onboarding instead of bureaucratic, paper-based applications still seen in the industry. This is evident in its speed of account approval, which is less than 24 hours for 80% of applicants.

After account approval, it usually takes 5-7 business days to receive the new EFTPOS machine by post. So overall, you can get up and running in just over a week (but it can take 2 weeks).