Most consumers rely on their debit or credit card to pay for things in shops in Australia. Not having a working EFTPOS machine is therefore unwise for merchants, unless they are okay with losing out on sales.

But what if the internet isn’t reliable or even functional where the business is? Completing card transactions relies on the internet. Are there any workarounds without 4G, 5G or WiFi?

Thankfully, some card machines and payment software have a way of accepting cards offline. We look at your options in Australia.

How offline card payments work

First of all, “offline” card payments describe methods of reading a credit or debit card without the internet, but the information must later be submitted and verified online in some way.

You generally need online communication with card processors and banks to make security checks and move the money around.

Accordingly, card machines read the card offline, store the transaction and card information for a limited time (like 24 hours) and submit it when next online (within the time limit).

If the card was invalid, the transaction won’t go through, so the burden is on the merchant to ensure it’s valid and it is the cardholder paying.

Each merchant service provider has rules about how the cashier should verify the customer’s identity and validity of the card when there’s no internet connection. This could include:

- Checking the card expiry date

- Requesting a signature and checking it matches the one on the card

- Calling the card scheme for verification

- Writing down customer details

- Asking for a photo ID

This information might later be submitted to a bank or online.

Only cash doesn’t require an internet or telephone connection at any point, since the monetary value is physically present and given to the cashier.

EFTPOS machines accepting cards offline

Not all payment providers in Australia have EFTPOS terminals with an offline mode. We’ve done the legwork for you and found only three that currently do:

Square: offline mode without monthly EFTPOS fee

The best offline EFTPOS option for a small business that can’t commit to a monthly fee is Square. Unlike Zeller (its Australian competitor), Square has an offline mode in all of its point of sale (POS) apps and EFTPOS machines. It needs to be manually switched on before the app goes offline.

Although the POS apps don’t work optimally if the 4G or WiFi drops, the offline mode ensures you can still accept Visa, Mastercard, American Express, JCB, eftpos cards if co-branded with Visa or Mastercard, Apple Pay and Google Pay.

It varies which Square terminals can accept chip, contactless or swipe cards offline, so you should check that first.

Square’s offline mode is also dependent on a few things: you can’t delete or log out of the app while offline, you can’t factory reset your mobile device while offline, and the app must be back online within 24 hours to automatically complete the transaction.

Square charges the same for offline as for online transactions: 1.6% for all cards.

Westpac: offline via insertion or swipe only

Westpac’s EFTPOS machines have an Electronic Fall Back (EFB) mode, allowing transactions to be processed offline and later forwarded to the banks for completion. This setting is automatically switched on if there’s a network outage.

There are limits on the maximum transaction value you can process with Westpac offline. If a credit card transaction exceeds the limit, the cashier will be prompted to call a phone number for an authorisation code. eftpos debit cards, on the other hand, can’t process amounts over the limit.

Unlike Square, Westpac can’t process cards offline via contactless, whether that’s a physical card or mobile wallet. Customers have to insert or swipe a card. This leaves out mobile wallets users entirely.

The cashier also needs to ask the customer for their signature even if a PIN is entered. This is to back up the claim that it is really the cardholder paying, not someone else.

CommBank: offline EFTPOS mode or manual vouchers

When CommBank’s EFTPOS terminals disconnect from the internet, their offline mode (called Store & Forward) switches on automatically.

Like Westpac, it has certain transaction limits dependent on the type of card, though a customer signature is not required for all transactions. The merchant just has to follow the instructions on the terminal screen and keep the merchant copies of the receipts.

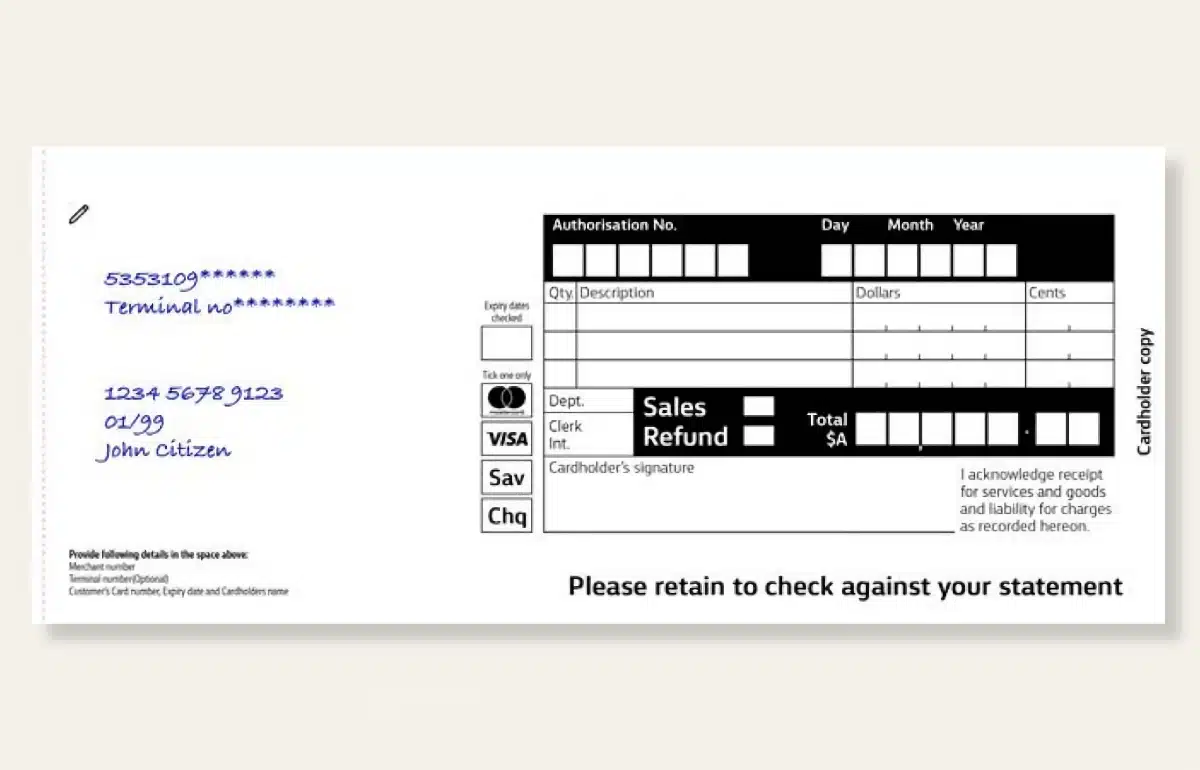

Alternatively, CommBank provides manual vouchers for when there are connection and power issues. This is more laborious, as it requires writing down details about the card, transaction and your business by hand.

The customer has to sign the slip and the cashier should compare that signature with the one on the card. If the card hasn’t been signed, you need to ask for a photo ID or call a number to verify the cardholder.

Our research found there is no offline mode on the EFTPOS machines of Tyro, Smartpay Australia, Zeller, NAB, Mint Payments or PayNuts.

Lightspeed Payments and Shopify card machines can work offline, but the feature is only available to some of its merchants (as “early access” or “beta”). Stripe Terminal has offline functionality, but it requires some complicated coding to set up with your POS system.

CommBank manual voucher to use when the EFTPOS machine is down.

The old fallback method: credit card imprinter

Until around the 1990s, a manual credit card imprinter was more widely seen around shops. You could use it today, but it does require some manoeuvring, writing details by hand and sometimes phoning the card scheme for verification.

This old-school device produces a carbon copy of a card’s main details on paper slips placed in the imprinting machine. The merchant would then fill in additional details and ask the customer to sign. The slips are later given to the bank for processing or submitted on a computer by the merchant in a virtual terminal.

Card imprinters only work if the card details are embossed on the card, since this is what leaves a copy on the carbon paper. But since not all cards today are embossed, it might not be the best solution for offline card processing (apart from how tedious it also is to swipe the machine).

Can payment links be a backup?

Recent years have seen the rise of a different method: paying online by link.

This would actually work when the customer is still at the point of sale, as the cashier can send a link from their phone (assuming their cellular network is still online) to the customer’s phone number or email address.

The customer can then pay on the spot if they open the link on their phone and complete the transaction in the online checkout like any other ecommerce sale.

To have this backup, the business needs to be signed up with a payment provider that can send payment links from an app. Transaction fees for pay-by-link are usually higher than EFTPOS fees, since more security protocols are used when the card is not electronically read in a card machine.

Agreeing on another way with the customer

If you can’t take the card payment upfront, you have a few last resorts that risk losing the customer – but they could save the sale.

You can obviously ask if they have enough dollars to pay in cash. People may likely have small amounts, but large amounts? Probably not. In that case, ask the customer to take out cash from an ATM and come back to pay.

Alternatively, get them to write down their phone number so you can call them if they’re willing to come back when the EFTPOS machine is up and running again.

If they can’t come back, you can take their card details over the phone and complete the transaction via keyed entry on the card machine or in a virtual terminal on a computer.