- Highs: No minimum term or cancellation fee. Same-day settlement. Accepts quite a few card brands.

- Lows: Requires NAB bank account. High upfront cost. High cost of replacement for card reader.

- Choose if: You already bank with NAB and want to keep things simple.

Note: NAB MPOS is no longer offered to new merchants. We recommend looking at the NAB EFTPOS Mobile solution instead.

What is NAB MPOS?

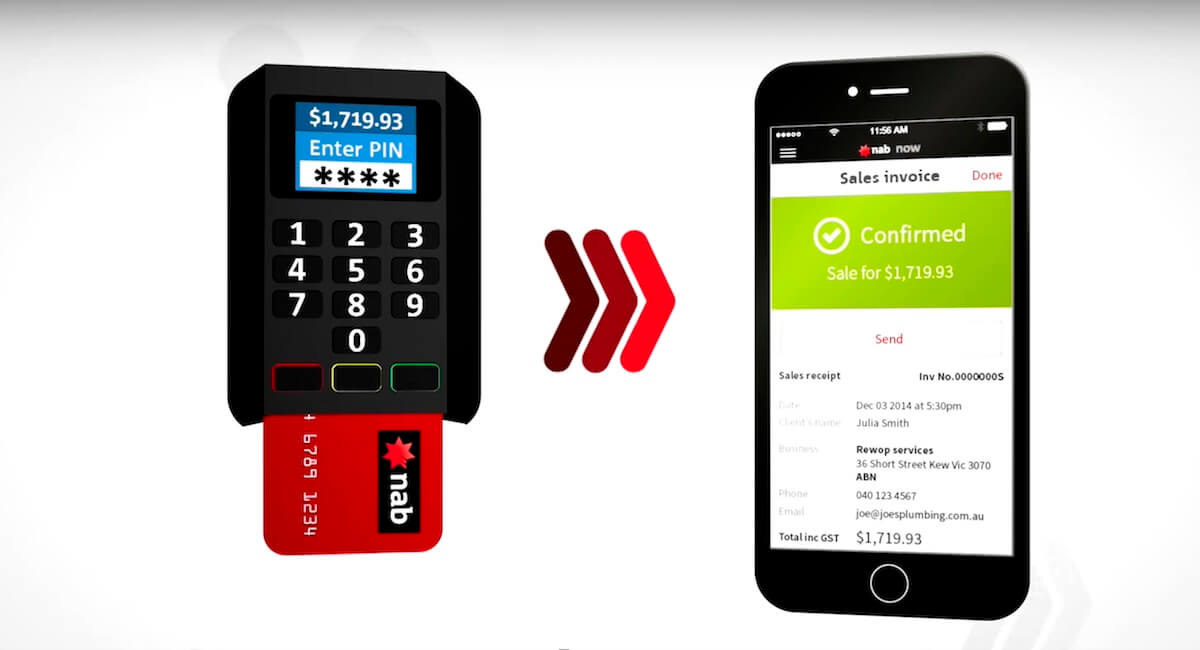

NAB MPOS is a mobile point of sale (mPOS) solution offered by National Australia Bank (NAB), one of Australia’s largest banks. The service was launched in early 2015 as Nab Now without contactless functionality, and later replaced by NAB MPOS with contactless functionality.

It principally targets small businesses in Australia who want to accept card payments on the go. According to the bank, the major benefits of NAB MPOS is to make card payments both easier and faster than traditional payment terminals.

Find the best alternative: Top EFTPOS machines for a small business

How it works

NAB MPOS enables merchants to accept payments from credit and debit cards, including Visa, Mastercard, American Express, UnionPay, Diners Club, JCB, Discover and eftpos.

During the transaction, the mobile card reader connects to your iOS or Android smartphone (or tablet) via Bluetooth, essentially turning your device into a card terminal. Operations are then managed with the ‘Quest mPOS with NAB’ app available in the App Store and Google Play.

The service is currently only available to those with business accounts at National Australia Bank. It therefore follows that if you don’t already have an account with the bank, then it will be necessary to open one in order to use NAB MPOS.

Payment app

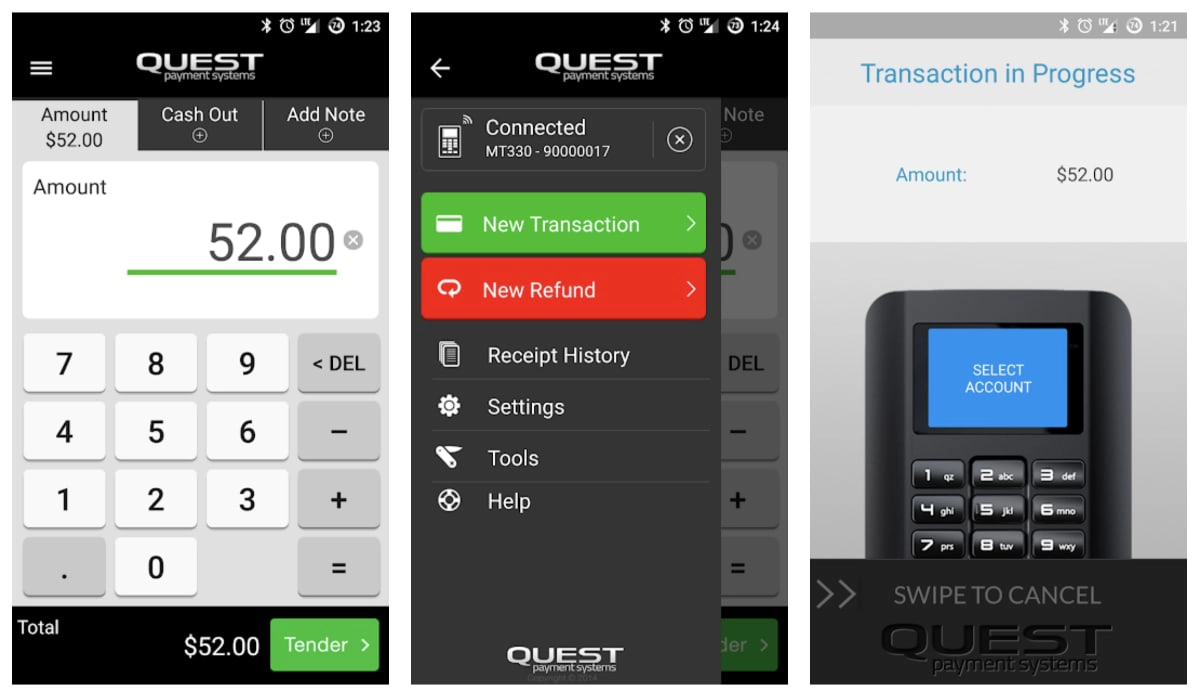

The Quest mPOS with NAB app is, as you’d guess, developed by Quest who has a very similar app for their own Quest Pocket Pay card reader (which happens to be the same card reader model as NAB’s, also developed by Quest).

The app is pretty intuitive, with just essential payment features like taking card payments, refunding transactions and sending email or SMS receipts. In the backend, you can view sales records and some analytics.

The app does not have enough downloads and reviews to make a judge on reliability across many merchants, but keep in mind that NAB is a bank, not a technology company. The more advanced mPOS services globally have all come out of newer, technology-oriented startups rather than traditional financial institutions.

App logo.

How much does it cost?

To get started with NAB MPOS, you first need to make an application and order a card reader.

The card reader costs an initial $135 followed by a $10 monthly fee plus transaction fees. The minimum you need to pay every month is $15, so if you don’t accept any transactions a month, you never only pay $10 – in that case, you will be billed $15 that month.

Additional card readers each cost $135 upfront.

We found it slightly odd to charge twice for renting the card reader. What’s more, replacement or non-return of the card reader at the end of the contract will set you back a whopping $350 (or $180 if outside of warranty).

The transaction rate is 1.7% for credit and debit cards and eftpos payments cost 30¢ each.

Advantages: same-day settlement and no contract lock-in

The principle advantage of NAB Now is that payments are settled in your bank account the same day. We suppose this is the upside of using a large bank such as National Australia Bank rather than a smaller startup-type company. This same-day settlement also applies to weekends which is an added bonus for merchants who require rapid cash flow.

Secondly, there is no minimum contractual commitment and no cancellation fee. This compares favourably to some of NAB’s competitors (for instance, Mint Payments and Quest Pocket Pay) charging penalties for leaving their services before a certain date.

However, as noted above, you must return the mobile terminal at the end of the contract, or be charged a hefty “non-return fee”.

The app for NAB is made by Quest Payment Systems.

Thirdly, invoices can be generated via email or SMS, which is a great relief from the paperwork burden that many small businesses face.

Finally, it might give you peace of mind to use a reliable and secure service from a major bank that won’t be going anywhere, anytime soon. Some merchants might prefer to use a solution from a name that is very recognisable and trusted.

Disadvantages: not a cheap card reader

NAB MPOS isn’t the most cost-effective mobile card reader out there. Although you are charged $135 upfront for ordering the mobile terminal, you do not actually own it given the monthly rental fee of $10 and excessive non-return fee if you fail to return it when cancelling the service.

In line with that, the miscellaneous charges such as those for card reader replacement seem excessive. Why does replacing a card reader cost so much more than ordering the first one? Again, this seems typical of what you might expect from a traditional bank.

If quick settlement is an upside of doing business with a large bank, then seemingly excessive fees and penalties might be some of the downsides.

Finally, the business account requirement with National Australia Bank could be a hurdle (and extra hassle) for some merchants. Conversely though, it may be an advantage for businesses who already bank with them.

Our verdict

Overall, we gave NAB MPOS is a good service with upsides such as rapid cash flow and no minimum commitment, but the card reader costs and requirement to bank with NAB end up bringing NAB Now down a few pegs.

The exception might be for those of you who already bank with NAB, in which case you may decide that keeping everything in one place is a more convenient option.

All things considered, we think it’s worth looking at options that could be better for you, such as Square and Paypal Here.