- Highs: Competitive transaction rates. Eftpos acceptance. Next-day settlement. Remote payments available.

- Lows: Annual contract required. $110 account closure fee. Early termination fee. Minimum monthly sales volume required. Outdated app.

- Choose if: Card sales amount to over $2,000 every month and you want an inexpensive mobile EFTPOS reader.

Accepted cards

The company offers a variety of payment services on a contractual basis. This includes an Ingenico Move 5000 terminal, app-based card reader (Mint mPOS), virtual terminal for over-the-phone payments, online payments and custom payments solutions for large businesses.

We will focus on Mint mPOS, which is a mobile payment solution aimed at small businesses. The card reader accepts contactless, swipe and chip-and-PIN credit and debit cards including eftpos.

Which EFTPOS machines got 4-4.5 stars? See the top 5 in Australia

How it works

Mint mPOS essentially turns your smartphone or tablet into an EFTPOS machine. The card reader is a standard Miura M010 model (same as PayPal Here’s) and connects to your mobile device via Bluetooth, meaning no special wires or cables are required.

The EFTPOS reader will fit in your pocket, making it ideal for on-the-go merchants who need to stay mobile. The Mint mPOS app can be downloaded on an Android phone, iPhone or iPad.

Payments are settled into your Australian bank account within 1-2 business days following strict PCI-DSS standards for a high level of security.

Mint Payments acts as a merchant service provider, but the acquiring bank Fiserv handles your merchant account that is bound by a 12-month contract.

What are the fees and ongoing costs?

Mint’s EFTPOS reader is free and there is no setup fee – nor is there a charge for using the Mint mPOS app. There’s no monthly fee when you transact for over $2,000 a month, making this a good deal for those with consistent sales volumes.

However, Mint mPOS comes with a year-long contract with Fiserv, and there’s a monthly fee of $11 incl. GST for the months you make less than $2,000 in card transactions. You only pay a 1.86% transaction fee for Visa and Mastercard payments and $0.33 per eftpos transaction (all fees include GST).

If you accept less than $22 per month through Mint mPOS, you will be charged a $22 monthly minimum fee. Chargebacks cost $25 each, and refunds cost the transaction fee originally charged for the payment.

Merchants who make over $20k monthly can negotiate custom rates that are lower than the above. In general, Mint likes to chat to prospective merchants for personalised solutions, as Mint mPOS is just one of several payment solutions on offer.

You need to contact Amex directly to set up a contract with them, since Mint does not provide Amex acceptance directly. Once an agreement is in place with American Express, the transaction fees and ongoing costs for that are paid directly to Amex, but it will be added as an accepted card brand through Mint mPOS.

Want no lock-in? Square has no monthly fees or commitment

Contractual lock-in and terms

You have to dig deep in the contractual terms to spot the possible extra fees, which is not great for a company that tries to appear transparent.

Importantly, the contract can only be cancelled with at least 60 days’ warning prior to the end of the current term. If you want to end the contract early, you pay an early termination fee equivalent to 80% of the average fees you would have paid if you kept the contract for the remaining months of the term.

Regardless of when you end the Mint contract, you will be charged a $110 closure fee – even if cancelling the contract with the required notice period. The trend for mobile card readers has long been moving towards no contact lock-in, so the service cancellation fees are a stretch.

There is a 12-month warranty included with the reader which is reassuring, but business owners should note that this is subject to various terms and conditions outlined in the contract.

Mint mPOS app

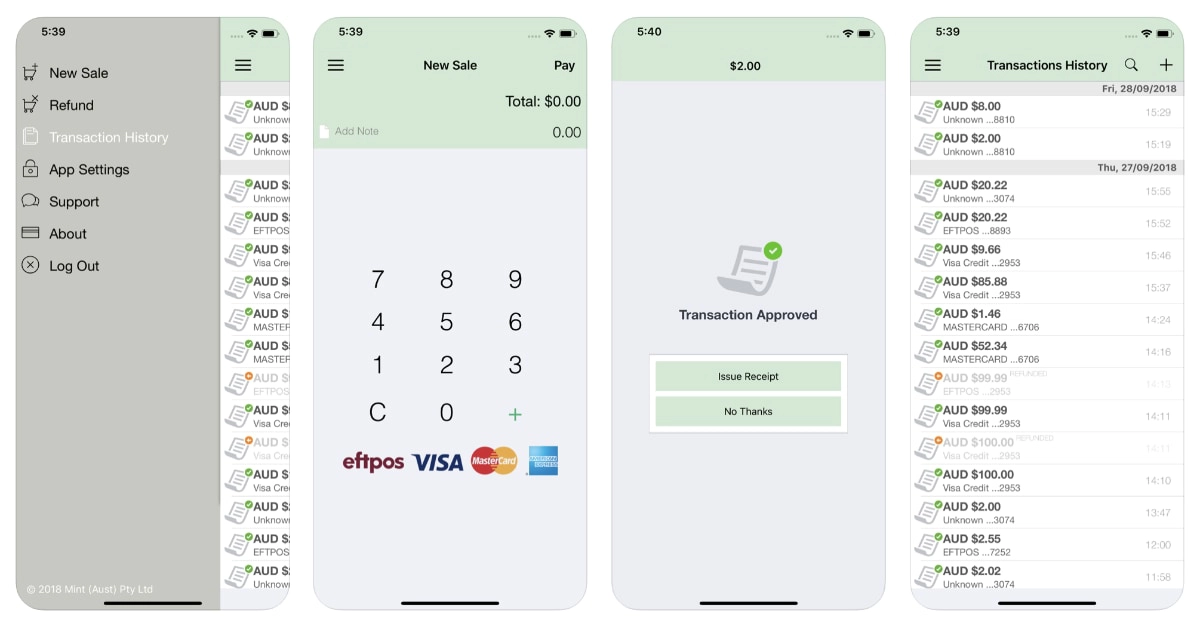

The app that works with the EFTPOS reader is for basic transactions only. That is, you can only enter transaction totals, not itemise a bill with different products. A note can be added to each transaction for reference, and you can add surcharges.

A digital receipt can be sent to the customer following each transaction, which requires an email address or mobile number. Through the app menu, you can go to view a transaction history, refund EFTPOS payments and adjust settings for receipts.

Image: App Store

You can view a transaction history, and accept or refund payments in the Mint mPOS app.

The mPOS app is quite basic compared with similar solutions available in Australia, but it does the basic job of accepting cards on the go. However, the app hasn’t been updated since October 2018 at the time of writing – a sign that Mint is not actively fixing bugs.

Mint recommends the mPOS app for field service operators, tradies, taxi drivers and sales representatives. Although it works for cafés, restaurants and retail shops (also suggested recommendations by Mint), this app is far too basic for those who need payments connected with an inventory or hospitality system.

Merchant Portal

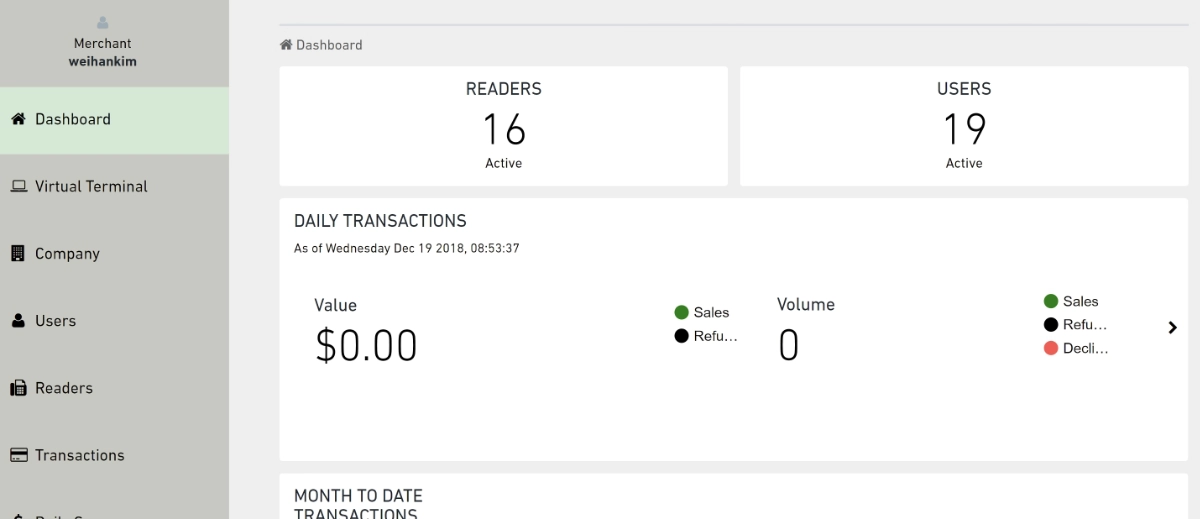

Mint mPOS comes with a Merchant Portal accessed through any web browser. Through the online portal, the business owner can check sales remotely in real time as payments from customers are processed through the mPOS reader.

What’s more, you can search through transactions, export daily sales reports and add different user logins for employees to distinguish their sales in the system. A company logo can be added for digital receipts, and business details edited any time.

Image: Mint Payments

Mint online portal is relatively basic, but has a virtual terminal for remote payments.

But perhaps the most valuable thing is the Virtual Terminal for telephone payments. This is basically a web page for entering transactions manually – useful for taking deposits while on the phone with a customer. You can also copy and paste a URL to send to customers who want to pay online on a secure web page. Different transaction rates apply to these transactions (from 1.5% per remote payment), and you may need permission from Mint to activate these functions.

Our verdict

Mint mPOS is a respectable card reader with a competitive transaction rate – if you make above $2,000 monthly and can stomach the $110 closure fee.

Otherwise, it becomes a service costing a monthly fee that could’ve been avoided by opting for a no-contract pay-as-you-go solution. That being said, the virtual terminal and payment links are useful options for socially distanced payments.

The payment app is not the most feature-rich compared to PayPal Here or Square, but it will do for simple payments on the go. It’s concerning the app hasn’t been updated for two years – usually, that means the company is not investing much in the product, and it increases the likelihood of technical glitches.

Mint’s website looks attractive and modern, but lacks transparency around contractual commitment and terms. That’s a disappointment, and something you should be inquiring about during sign-up before locking yourself into a year-long solution that may not be right for your business. That being said, Mint’s rates can be negotiated with a monthly sales volume above $20k – very valuable for mobile merchants with high-ticket clients.