For a small business, choosing the wrong EFTPOS machine can be costly, particularly when margins are tight and it's unclear where you stand in a couple of years.

You don't want to tie yourself to a longer-than-necessary contract, and transaction fees and monthly costs (if any) should be fair for your sales volume.

Traditionally, an EFTPOS terminal was obtained from banks, but modern card reader providers now provide simplified pricing, pay-as-you-go fees and no commitment.

Let's compare the best EFTPOS machines that currently lead among small businesses in Australia.

Contents

EFTPOS machines:

Compare EFTPOS machines in Australia:

| Company | EFTPOS machine |

Costs | Key facts | Sign-up |

|---|---|---|---|---|

| Square Reader $65 (purchase) Independent terminals $329–$349 (purchase) Option to pay over 3-12 months |

No monthly fee No lock-in Transaction fee 1.6% |

Industry-leading all-rounder with POS and online payment tools. Instant payouts possible. |

Short online form, quick acceptance: |

|

| Zeller Terminal $99–$199 (purchase) |

No monthly fee No lock-in Transaction fee 1.4% |

Lowest fixed fee, surcharging, online account and card | Short online form, quick acceptance: |

|

| Verifone or PAX models $0 or $29/mo (rental) |

No setup fee No lock-in Transaction fees 0.8%–1.5% |

Fee-less plan with surcharging with $10k+/mo turnover, or low variable rates | Tailored quote, online registration: |

|

| Ingenico or Verifone models $24.75- $35/mo (rental) |

No setup fee No lock-in Transaction fees 1.2% and up |

Overall best among the Big 4 banks | Online registration, possible quote: |

|

| Verifone and Ingenico models $29.50/mo (rental) |

No setup fee No lock-in Transaction fee 1.1% or custom |

Mobile smart terminal with a few apps | Online registration, possible quote: |

|

| Tyro Pro $29 (rental) Tyro Go $39 (purchase) |

No setup fee No lock-in 1.4% or custom transaction fees |

Updated EFTPOS packages that work with most POS systems | Tailored quote, slow onboarding: |

|

| PAX A920Pro No rental fee if minimum is met |

Monthly/1-year contract Surcharging rates by negotiation |

Surcharging plans, fast onboarding, but with limitations | Tailored quote: |

|

| Ingenico or Quest model $25/mo (rental) |

Monthly contract No setup fee Transaction fees from 1.15% |

Fees competitive, ease of use lacking | Online registration, possible quote: |

| Company | EFTPOS machine |

Costs | Sign-up | Key facts |

|---|---|---|---|---|

| Square Reader $65 (purchase) Independent terminals $329–$349 (purchase) Option to pay over 3-12 months |

No monthly fee No lock-in Transaction fee 1.6% |

Short online form, quick acceptance: |

Industry-leading all-rounder with POS and online payment tools | |

| Zeller Terminal $99–$199 (purchase) |

No monthly fee No lock-in Transaction fee 1.4% |

Short online form, quick acceptance: |

Lowest fixed fee, surcharging, online account and Mastercard | |

| Verifone or PAX models $0 or $29/mo (rental) |

No setup fee No lock-in Transaction fees 0.8%–1.5% |

Tailored quote, online registration: |

Fee-less plan with surcharging with $10k+/mo turnover, or low variable rates | |

| Ingenico or Verifone models $24.75- $35/mo (rental) |

No setup fee No lock-in Transaction fees 1.2% and up |

Online registration, possible quote: |

Overall best among the Big 4 banks | |

| Verifone and Ingenico models $29.50/mo (rental) |

No setup fee No lock-in Transaction fee 1.1% or custom |

Online registration, possible quote: |

Mobile smart terminal with a few apps | |

| Tyro Pro $29 (rental) Tyro Go $39 (purchase) |

No setup fee No lock-in 1.4% or custom transaction fees |

Tailored quote, slow onboarding: |

Updated EFTPOS packages that work with most POS systems | |

| PAX A920Pro No rental fee if minimum is met |

Monthly/1-year contract Surcharging rates by negotiation |

Tailored quote: |

Surcharging plans, fast onboarding, but with limitations | |

| Ingenico or Quest model $25/mo (rental) |

Monthly contract No setup fee Transaction fees from 1.15% |

Online registration, possible quote: |

Fees competitive, ease of use lacking |

Our card machine ratings

We test and research the products we write about for an honest rating.

The most important rating criterion is the product: does it work well as a card machine? Is it easy to accept chip and tap cards? Does it have a long battery life, accept many types of cards and have useful features like surcharging?

How the EFTPOS machines compare on our criteria:

| Card machine | Product | Fees | Extras | Contract | Sign-up | Service |

|---|---|---|---|---|---|---|

| Square | 4.3 | 4 | 4.7 | 5 | 4.8 | 3.6 |

| Zeller | 4.6 | 4.4 | 4 | 5 | 4.3 | 4 |

| PayNuts | 4.4 | 4 | 3.8 | 4.9 | 3.8 | 4.2 |

| Westpac | 4.1 | 3.7 | 3.8 | 3.9 | 3.7 | 2.7 |

| CommBank | 4 | 3.8 | 3.8 | 3.8 | 3.6 | 3.2 |

| Tyro | 4 | 3.9 | 3.8 | 3.9 | 3.2 | 2.7 |

| Smartpay | 4.2 | 3.7 | 2.7 | 3.8 | 3 | 4 |

| NAB | 3.7 | 3.9 | 3.6 | 3.7 | 3.8 | 3 |

Summary of our findings:

Best product: Zeller has the most popular EFTPOS terminal with its free business account and debit card for small businesses. PayNuts' quality terminals come second and Square third with their user-friendly, reliable designs.

Best fees: With a low fixed rate and no monthly fees, Zeller is the most affordable EFTPOS package. Square's many free tools, simple fees and instant payouts take second place. PayNuts has the fairest tailored rates.

Best extras: Square has the most accessible, widest range of free business software that includes online payment methods, ecommerce, invoicing, POS apps and detailed reports.

Best contract: Zeller and Square are the only contract-free EFTPOS providers where you don't need to cancel and can keep the terminals. PayNuts' lack of lock-in comes third, but their terminals need to be returned.

Best sign-up and transparency: Square has the simplest, fastest sign-up on their website, with no need to speak to anyone. Zeller is relatively easy to register with, but requires more information, and verification can take a bit longer.

Best service: PayNuts' customer service gives us the best impression with their genuinely helpful approach and 24/7 support. Zeller gets good reviews from users and offers fast terminal replacement.

Pros:

Cons:

Square was the first company in the world to release a card reader for mobile phones.

Since its arrival in Australia, the local banks and other payment providers looked old-fashioned in comparison. Why? Because Square champions affordable EFTPOS for small business without contractual lock-in, hidden fees or complicated terms.

In addition, a free point of sale system makes selling goods and services fun.

Square pricing:

| Square Reader | Square Terminal | |

|---|---|---|

|

|

|

| EFTPOS machine | Card reader connected to free phone/tablet app | Standalone, portable touchscreen terminal (WiFi) |

| Price (purchase) | $65 incl. GST or 3 x $22/mo instalments |

$329 incl. GST or 12 x $28/mo instalments |

| Transaction fee | 1.6% | |

| Contract | No lock-in, no monthly fee | |

| Payouts (free) | Next day (incl. weekends) | |

| Instant transfers of funds | 1.5% fee applies | |

You simply pay for a card reader upfront to own it forever, and pay only a fixed rate of 1.6% for all card transactions incl. with foreign, premium and eftpos cards. There are no monthly fees or other ongoing costs to worry about, nor do you have to return the hardware when it's no longer needed.

"In my tests, Square has always processed payments promptly and impressed me with their constant new features and crisp, but user-friendly, apps."

– Emily Sorensen, Senior Editor, Mobile Transaction

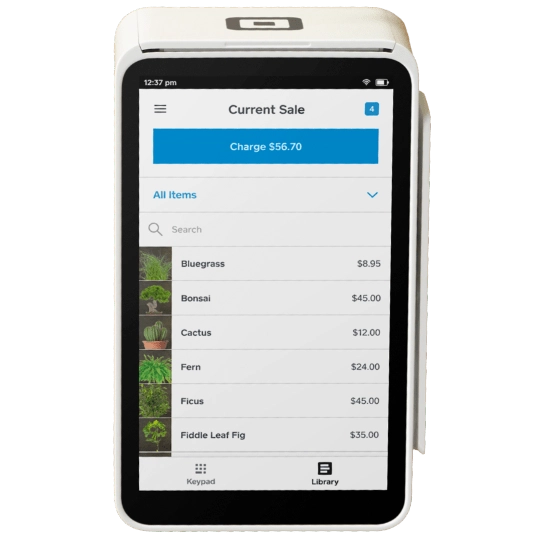

Square Reader ($65 incl. GST) works in conjunction with a free Point of Sale (POS) app on your phone or tablet connected with 4G or WiFi. It's the smallest card reader we've tested, and the app it works with is regularly updated to avoid bugs and issues.

Photo: Mobile Transaction

Square Terminal and Square Reader are great EFTPOS terminals.

The app has a wealth of features for most face-to-face merchants, e.g. product library, tipping, taxes, employee accounts and a customer library. On top of this, you get invoice tools, a virtual terminal for over-the-phone payments and ecommerce options like an online store.

Alternatively, you can subscribe to Square's specialised POS systems for retail, hospitality or appointments scheduling.

There is also the more expensive, portable card machine Square Terminal ($329 incl. GST) and Square Handheld ($349 incl. GST), which only work through a secured WiFi connection. They don't need a connected mobile device and have a touchscreen display with the POS features of Square's apps.

Accepted cards

With any of the EFTPOS readers, you can split the purchase cost into instalments paid over 3, 6 or 12 months.

Online payments and key-in payments via the free Square app or Virtual Terminal cost 2.2% per transaction.

Merchants can surcharge on the EFTPOS machines to avoid the Square rate, which is not the lowest on this best-of list.

The free payouts reach your bank account the next day, even on weekends, but qualifying merchants can get funds instantly for an added 1.5% fee.

Pros:

Cons:

Zeller has already become a top contender in the Australian payment space since its launch in 2021 – and it keeps getting better.

Initially, only Zeller Terminal 1 impressed with a simple transaction interface, but the company recently launched Zeller Terminal 2 with attractive POS software installed.

The card machines have no setup or monthly fee; you just purchase it upfront for as little as $99 (incl. GST and a 12-month warranty), and it's yours indefinitely. Zeller has pulled their terminals out of the Officeworks network and now focuses on keeping the price low from its own website.

There's no contract lock-in, only a pay-as-you-go transaction fee of 1.4% for chip and contactless card payments.

You can activate the surcharge function to avoid the transaction cost, as long as cardholders are happy to pay this fee. Unlike some of the big banks, Zeller does not add a commission on surcharges.

Zeller pricing:

| Zeller Terminal 1 | Zeller Terminal 2 | |

|---|---|---|

|

|

|

| EFTPOS machine | Standalone, mobile touchscreen terminal (WiFi, 4G with SIM) |

Standalone, mobile touchscreen terminal (WiFi, 4G with SIM) |

| Price (purchase) | $99 incl. GST | $199 incl. GST |

| Transaction fee | 1.4% | |

| Zeller SIM Card (optional) | $15/mo | |

| Contract | No lock-in, no monthly fee | |

| Payouts | Same day in Zeller Account, next business day in bank account | |

Zeller includes a free online account where you can receive transactions the same evening at midnight. This is linked with a business Debit Mastercard (in the package), so you can spend the money from the next morning. We like that the card is activated for Apple Pay, and corporate cards for employees are available.

Alternatively, a business bank account from any Australian bank can receive transactions the next business day.

Transactions and payouts are shown in a web portal and app that also accepts tap-to-phone transactions and sends invoices.

A Zeller EFTPOS terminal comes with an online business account with a linked Mastercard.

Zeller Terminal 1 – available with a charging stand – has a receipt printer and large touchscreen showing a simple checkout for entering a transaction amount, adding a tip or surcharge and accepting the card. Customers can enter their PIN on the on-screen PIN pad.

The new Terminal 2 has actual POS software like a product library to make it more versatile, but no receipt printer.

"We are impressed with Zeller Terminal 2's unique beauty, but also the fact it's faster – and the screen 18% larger – than any other EFTPOS machine in Australia at the moment. The battery also lasts 30% longer than its predecessor."

– Emily Sorensen, Senior Editor, Mobile Transaction

Both have day-long battery lives and work through WiFi, but a SIM card should be purchased if mobile connectivity is needed.

Accepted cards

They integrate with leading POS systems, accounting, ecommerce and Buy Now Pay Later solutions.

One of the latest functions is Pay at Table, available free of charge for H&L point of sale users, to help restaurants turn tables faster with fewer errors. More features are continually added, such as split bills and showing a business logo on the EFTPOS machine.

Last but not least, Zeller generous support is available to phone every day of the week between 9 AM and 1 AM (AET).

Overall, Zeller has evolved into a complete solution for many businesses looking for EFTPOS, a business account, spend management, invoicing and integrations with accounting and points of sale.

Pros:

Cons:

Previously More Payments, PayNuts offers a range of payment solutions for small businesses, mainly EFTPOS terminals without contractual commitment.

There are no fees for setting up, shipping, contract termination (it is cancellable any time), refunds or payouts. Other fees depend on your chosen plan which is either Pay Nothing or Low Fee EFTPOS.

PayNuts pricing:

| PayNuts | |

|---|---|

|

|

| EFTPOS machine | Standalone, mobile and portable EFTPOS machines |

| Rental plans | Low Fee: $29 incl. GST/mo Pay Nothing: Free with $10k+/mo turnover, $29/mo if less |

| Transaction fees | Low Fee: 0.8%–1.5% (depends on card, turnover) Pay Nothing: Passed on to customers |

| Contract | No lock-in, setup fee or monthly min. charge |

| Payouts | Next business day in bank account |

If you opt for the Pay Nothing EFTPOS plan, you'll be passing on transaction costs to the customer with a surcharge. Plus, if you make over $10k monthly in card transactions through the specific terminal, there is no cost at all on this plan. No other fees apply, not even for chargebacks or receipt rolls.

The Low Fee plan always charges $29 monthly for EFTPOS rental regardless of turnover, and a mix of extra fees apply for e.g. chargebacks. The exact costs are tailored for your business and on the low side compared with alternatives.

PayNuts offers a "pay nothing" plan where transaction fees are passed on to customers.

The Low Fee transaction costs are not as simple as a fixed percentage, but they are lower – between 0.8% and 1.5% depending on your type of business and revenue. This includes GST, the card scheme's (e.g. Visa, eftpos) variable rates and PayNuts' merchant service charge. Regardless of how little you earn, you generally get good rates, but the sales volume does factor into it.

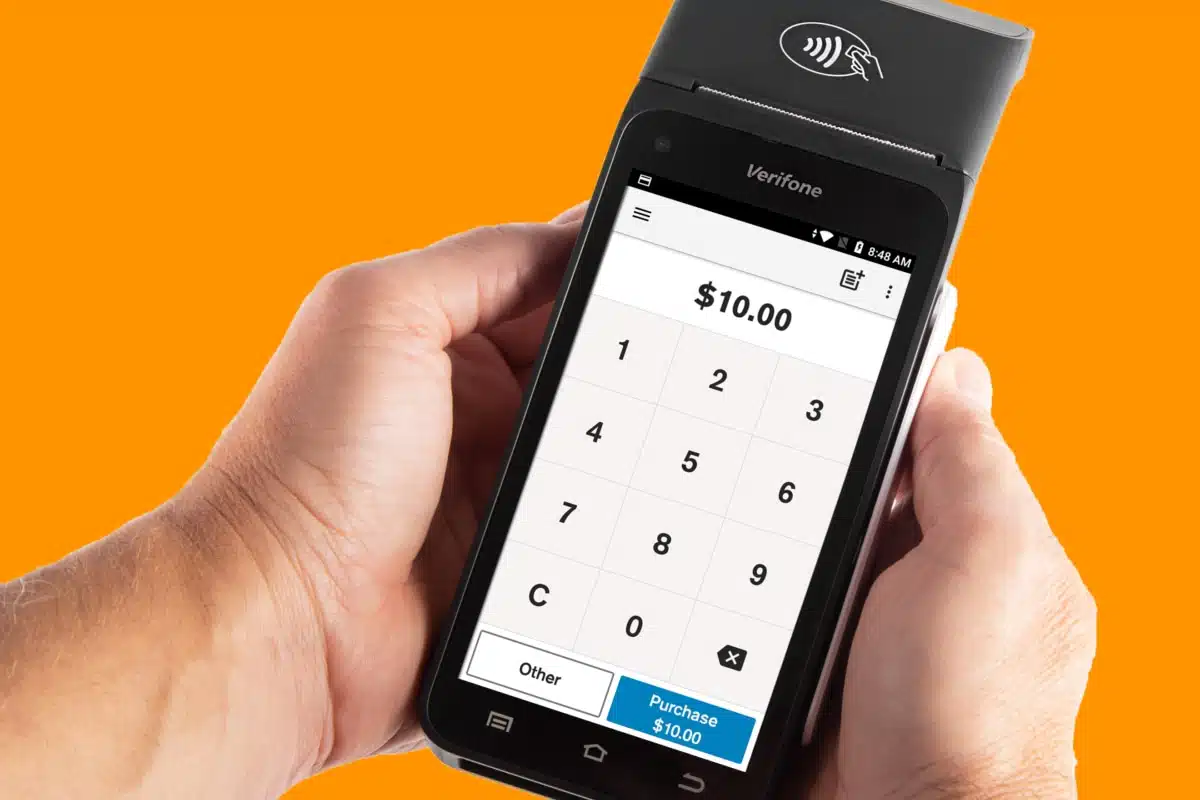

PayNuts' main EFTPOS machine is the mobile and portable Verifone T650p touchscreen terminal. It integrates with a huge choice of POS systems – over 700 software providers – but can be used independently. As a smart terminal running on Android, we find the touchscreen a pleasure to use.

Accepted cards

Two other terminals have recently been added to the selection: the portable and mobile PAX A910S and mobile PAX A77 terminal. The PAX A910S terminal is "best in class" according to PayNuts, but it is chunkier than the smartphone-like A77 which fits in a pocket.

PayNuts accepts most cards by default – good for merchants serving tourists with international cards – but American Express requires an extra contract. Buy Now Pay Later options are also available: Afterpay and Zip Pay.

Transactions are deposited into your bank account at any Australian bank the following working day. Same-day funding is available for an additional cost.

Pros:

Cons:

Australian bank Westpac offers one of the best EFTPOS machine packages on the market. They've caught up with the fact that small businesses prefer less bureaucracy, modern terminal solutions, simpler fees and no commitment.

Westpac caters to most checkout setups with its mobile, portable and stationary touchscreen terminal (EFTPOS Now), stationary machine (EFTPOS Connect) and self-service terminal (EFTPOS Flex).

Photo: Westpac

The EFTPOS Now smart terminal is attractive-looking.

EFTPOS Now, a Verifone T650p model, is a beautiful touchscreen terminal that works independently in all situations, anywhere with WiFi or 4G. The basic package does not integrate with POS software, but is instead a "mini point of sale" with useful features like tipping, preauthorisations and split bills. It does all this through its fully-touchscreen interface, which will appeal to modern businesses.

With the 'Presto' add-on (costs extra), EFTPOS Now integrates with most POS systems, making it ideal for countertops and shop floors.

Accepted cards

The second option, EFTPOS Connect, is an Ingenico Move 5000 model that integrates with even more retail and hospitality software systems. It is used in large stores and allows you to add a logo on the screen for extra professionalism. The Flex terminal for self-service checkouts and kiosks is mainly for large retailers.

The bank charges a monthly rental subscription of $24.75-$35, depending on the chosen terminal. Then you pay a fixed rate of 1.2% per card transaction accepted, or custom fees if your business qualifies for it.

Either way, the costs are best for a steady turnover, and you get same-day payouts with a Westpac bank account. A maximum fee of $550 (incl. GST) is charged if you fail to return the terminal upon ending the contract, or if it gets damaged.

The only free solution is Westpac Air, an app on your smartphone that accepts contactless taps directly on the back of the phone (for 1.4% per transaction).

Pros:

Cons:

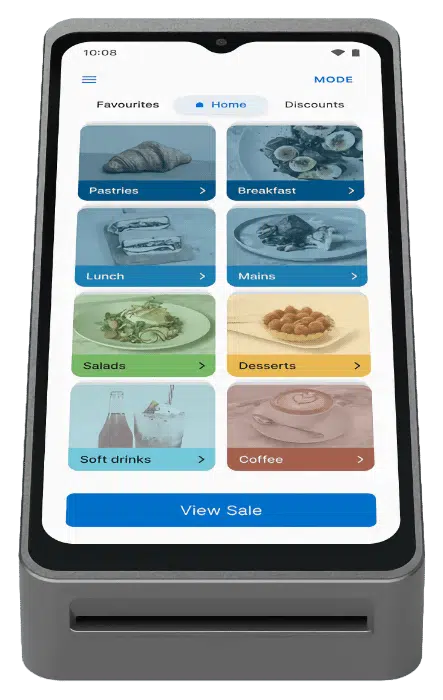

The latest terminal from Commonwealth Bank (CommBank) is a Verifone Carbon Mobile 5 model named 'Smart'. It attracts high scores for design and functionality, ideal for businesses on the go who do not have complex inventories. A simplified point of sale (POS) system is accessed on its touchscreen display.

Photo: CommBank

The terminal is a new-generation Android smart terminal, which is a step up in user experience.

It integrates with points of sale through a connector app, but not all POS systems are compatible. The terminal comes with a few other apps, like Smart Giving for receiving donations and Smart Hospitality for taking orders table-side.

There are no setup fees or lock-ins, but the replacement fee of $500 in case of non-return or a broken terminal can be a stressor for some.

The flat, blended fee of CommBank is competitive. As with the other big five banks, though, we have received reports of hidden costs on top of the monthly rental fees.

Accepted cards

While the consumer app of CommBank receives praise, the app for business has lagged behind. This means that analysing sales and performing other tasks, such as sending invoices, just won't be as pain-free as with the providers on top of this list.

A few EFTPOS terminals are available through CommBank (Smart Integrated and Essential Plus) for the same rental and transaction fees. In addition, the Square-lookalike Smart Mini costs $59 upfront to purchase, but requires a very basic phone app to operate.

Pros:

Cons:

Tyro offers two portable and mobile EFTPOS machines (Tyro Pro) for rental and app-based card reader (Tyro Go) with no monthly fee.

You pay $29 monthly for Tyro Pro Touch (with a large touchscreen) or Key (with a keypad and touchscreen display) that work with 4G or WiFi and integrate with most POS systems. The service is cancellable any time, but you have to return the terminal when leaving the contract.

Tyro pricing:

| Tyro GoEFTPOS | Tyro Pro Touch EFTPOS | |

|---|---|---|

|

|

|

| EFTPOS machine | Card reader connected with mobile app | Mobile card machine (WiFi, 4G) |

| Cost | $39 incl. GST (purchase) No monthly fee |

$29 incl. GST/mo (rental) |

| Transaction fees | Below $20k/mo turnover: 1.4% incl. GST $20k+/mo turnover: Tailored Cross-border fee: 0.4% + 0.4% if using DCC |

|

| Contract | No lock-in, no setup fee | |

| Payouts | Same day in Tyro Bank Account, 1-2 business days in other bank account | |

Alternatively, the new Tyro Go card reader can be purchased upfront for $39, and there is then no monthly fee, just transaction fees.

"Tyro's card reader looks modern, but its app is rarely updated and not very good. But my tests of Ingenico Axium DX8000 (Tyro Pro Touch) have been positive, so this shouldn't have issues unless Tyro's software fails."

– Emily Sorensen, Senior Editor, Mobile Transaction

Whatever the choice, there's no contractual lock-in or setup fee, meaning you can sign up without too much risk.

If your business transacts for less than $20,000 per month and you rent a terminal, your transaction rate is fixed at 1.4% across cards. A card turnover above $20k monthly gives the merchant custom rates dependent on the business, turnover and cards accepted.

Photo: Mobile Transaction

Tyro EFTPOS machine is ideal for merchants who want a cutting-edge device on a simple rental plan.

The rented Tyro Pro machines, manufactured by Ingenico, are hard-wearing and look professional on a countertop or outside. They're a big step up from the previous Tyro terminals that were very outdated and had technical problems in early 2021, but the new card machines are much better.

Accepted cards

If you're planning to use surcharges, the dynamic surcharging feature on the card machines is perfect for whichever kind of fee you're going for.

Payouts settle in your bank account within 1-2 business days, whereas a Tyro Bank Account gives you access to funds the same day.

Pros:

Cons:

Smartpay offers a Zero Cost plan only suitable for some businesses, and it requires surcharging to avoid fees. What's more, the terminal has limited features apart from basic card transactions.

The company has attracted a solid fraction of Australian small businesses as its customer base with its surcharging plan. Keen to boost margins, sellers have opted for the "zero cost" plan to pass on the processing fees – but it is not for everyone.

Smartpay pricing:

| Surcharging (Zero Cost) plan | Simple Flat Rate plan | |

|---|---|---|

| Eligibility | Over $10k/mo in card transactions | No minimum turnover, less interesting for below $15k/mo in card transactions |

| PAX D210 terminal | Included | Included if processing $15k+/mo |

| Transaction fees | Passed on to customer depending on card used, possible for merchant to absorb | One flat fee paid by merchant regardless of card |

| Payouts | Next business day | Next business day |

| Contract | 12 months, or cancellation fee | No lock-in, no setup fee |

For a start, the smallest businesses accepting less than $10,000 in card payments per month through the card machine won't qualify. However, the onboarding process is typically faster than that of a traditional bank.

At the time of writing, only one terminal is offered by Smartpay, the PAX A920Pro model. This is a vast improvement on the last EFTPOS machine Smartpay offered up to recently, so we're happy to see some progress with the company.

Photo: Mobile Transaction

PAX A920Pro (pictured) is a big upgrade from the old Smartpay terminal.

Fees are negotiated and based on your industry and sales turnover. For premium cards, they can end up on high side compared with other EFTPOS terminal providers.

The standard payment cards accepted include Visa, Mastercard and eftpos. With an additional contract and higher rates, it is possible to accept American Express. Deposits of funds happen the next business day.

Accepted cards

Available with extra contract

Smartpay says the plans are cancellable any time, but this comes with an exit fee if terminating the contract before 12 months. Lower monthly rental fees can be negotiated with a longer contract. With more players on the market offering surcharging without extra fees, the draw of Smartpay is not as strong as it used to be.

Pros:

Cons:

On paper, the offering from NAB looks fairly competitive. The biggest draw for many is the same-day settlement of funds if you are a NAB business account customer.

Their integrated EFTPOS terminal, Ingenico Move 5000, is hard to fault. We've used it many times and find it straightforward to use, with both a colour touchscreen and push-button PIN pad to aid accessibility. It connects with almost any POS system and can be used wired or wireless.

Not using a point of sale system? The standalone Quest QT850 NAB's solution for that. It has a touchscreen and works on the go or in store with its basic payment software.

Photo: NAB

Ingenico Move/5000 is highly reliable and suited both on a counter and portably.

At second glance, the story is more mixed. The standalone or integrated terminal costs $25 monthly, which is one of the lowest rental fees on this list, but it still exceeds the cost of purchasing comparable smart terminals from providers higher up this list over the course of a year.

NAB's fixed card processing rate of 1.15% is competitive, but it only applies to Visa, Mastercard, eftpos and UnionPay cards. To accept American Express, JCB or Diners Club, rates have to be negotiated individually for separate contracts, resulting in more paperwork and fees at the high end – unless the processing volume is high.

Accepted cards

Separate contract, extra fee

Despite fees being a mixed bag, the cost alone is likely not the main reason many businesses wish to look elsewhere. While the NAB consumer banking app is getting mainly positive feedback, the same cannot be said about the ease of the business app, nor the web dashboard. The day-to-day administration of the account just isn't as good as one would expect from a digital solution.

Transfer speeds compared

We know that many merchants want fast deposits for EFTPOS transactions. Urgent bills can be paid quickly if card takings are accessible the same or next day – but not all providers offer settlement faster that the next 1-2 business days.

Overview of payout times among EFTPOS providers:

| Company | Transfer speed options |

|---|---|

| Zeller | Fastest: Midnightly deposits 7 days a week in Zeller account (free) Slowest: Next business day in bank account (free) |

| Square | Fastest: Instant in bank account (1.5% fee) Slowest: Next day in bank account (free) |

| PayNuts | Fastest: Nightly deposits 7 days a week in bank account (for a fee) Slowest: Next business day in bank account (free) |

| Westpac | Same day 7 days a week, at a set time, in Westpac bank account |

| CommBank | Nightly deposits 7 days a week in CommBank bank account |

| Tyro | Fastest: Nightly deposits 7 days a week in Tyro bank account (free) Slowest: 1-2 business days in other bank account (free) |

| Smartpay | Next business day in bank account (free) |

| NAB | Nightly deposits 7 days a week in NAB bank account |

Square is the only one that offers instant deposits, but it comes at a cost of 1.5% added to the transaction rate.

All others except for Smartpay have an option for nightly payouts, typically in a business account from the same bank or provider.

Other EFTPOS machines just didn't make sense to recommend unless you already use the company's services (i.e. Stripe and Shopify).

Some terminals in Australia have been discontinued or are less popular, but the EFTPOS market is moving so we hope to see more competition in 2025.

Summary

The EFTPOS solutions with least commitment remain Square and Zeller, since they have no monthly fees or contract lock-in.

Square can get you started with the cheapest card reader, POS apps and the most free payment tools. Zeller's high-performing, versatile touchscreen terminals have a low rate and a free business account, Debit Mastercard and useful extras like POS integrations and invoicing.

PayNuts offers the most attractive no-fee (i.e. surcharging) plan on the market, efficient onboarding and no contract. That said, both PayNuts and Smartpay have the requirement to sell for at least $10k monthly per EFTPOS machine to qualify for "zero cost".

The 'big 5' banks look fairly good on paper. We've tested the terminals they offer, and the card machines are difficult to fault in real life. What the big banks still lack is the ease of use of the digital services, and customer service.

Tyro is a popular provider with no contract, but its slow onboarding and problematic service have been issues for many merchants.

Here's a rundown of the best card machines for small-business owners:

| Provider | Best for | Offer |

|---|---|---|

|

Cheapest card reader for small business, free extra selling tools | |

|

Affordable touchscreen terminals with online account and Mastercard | |

|

No-fee plan or low, variable rates without lock-in | |

|

Good range of EFTPOS solutions for Westpac account holders | |

|

One of the lowest flat EFTPOS rates from a bank | |

|

Integrates with most POS systems, well-known brand | |

|

Potentially no fees with a turnover of over $10k monthly | |

|

Same-day settlement for most payment cards |