Many consumers in Australia prefer to use money they know they have. Credit definitely isn’t their first option. For these shoppers, debit from a savings account is the way to go, and in Australia, there’s a unique way of doing just that.

Eftpos (eftpos) is a privately-run, Australian debit card payment system. A long-standing staple of the country’s financial landscape, it has allowed electronic payments at the point of sale for four decades.

And while it might share the same name as the commonly used EFTPOS abbreviation (Electronic Funds Transfer at Point Of Sale), they are two very different things.

The rise and rise of eftpos

The eftpos payment system was launched in Australia during 1983. It introduced a quick, easy and secure way to pay in stores.

Quickly, it became the go-to choice of merchant payment systems in both Australia and New Zealand. 1.8 billion transactions totalling over $115 billion were processed via EFTPOS terminals during the 2017/18 period.

However, the rise of international schemes like Visa and Mastercard led to a decline among consumers in the use of eftpos cards over the last decade.

The eftpos logo.

But since forming the group Australian Payments Plus (AP+) in February 2022 with domestic payment companies BPAY Group and NPP Australia, eftpos has reclaimed market share from Visa and Mastercard.

This is thanks to a higher uptake of least-cost routing and eftpos’ new online payment service.

How does eftpos work in Australia?

The eftpos system is composed of seven proprietary networks which all interlink with each other. These networks are principally operated by the major Australian banks such as Westpac, Commonwealth Bank and National Australia Bank.

Almost all debit cards issued in Australia can process transactions via eftpos. These are known as dual-network cards because they support international schemes like Visa or Mastercard as well as the Australian eftpos system.

There are also about 5 million prepaid cards and over 5 million credit cards with eftpos functionality in circulation.

Australians have three payment options at the point of sale:

- Cheque (CHQ)

- Savings (SAV)

- Credit (CR)

‘Cheque’ and ‘Savings’ purchases are processed through eftpos. ‘Credit’ runs the transaction across the Visa or Mastercard network, depending on the card type.

The transaction amount is transferred to the retailer as soon as the payment clears.

Consumers will then instantly have funds deducted from their chosen account, making it a great way to keep track of money spent in real time.

Shoppers can also use eftpos to withdraw cash from any merchant accepting card payments. This makes life a lot easier if an ATM isn’t close by.

It’s also quite common for merchants to set a minimum purchase amount of $5 or $10 if shoppers want to withdraw cash. This is widely accepted by consumers in Australia as the trade-off for not having to look for an ATM — a win-win for both customer and retailer.

How can businesses accept eftpos?

Small businesses wanting to accept eftpos transactions will usually need to sign a contract with an eftpos-approved merchant service provider such as:

- Australia and New Zealand Banking Group

- Commonwealth Bank of Australia

- Cuscal

- Fiserv/First Data Network Australia

- National Australia Bank

- Tyro

- Westpac Banking Corporation

- Windcave

Certain payment providers also offer eftpos acceptance as a part of their package.

For example, the pay-as-you-go card reader service Square accepts eftpos cards without any contractual lock-in. Mint Payments also accepts eftpos in their all-inclusive EFTPOS packages.

These payment providers have their own agreement in place with one of the main merchant service providers offering eftpos contracts directly.

What does eftpos cost to accept?

The average eftpos merchant rate is around 0.3%, while Visa and Mastercard charge between 0.5% and 1% of the transaction total on average.

Credit cards can be accepted by entering into a separate agreement with the credit card company, with varying costs for the individual contracts. Alternatively, you can avoid signing a contract through a pay-as-you-go system like Zeller.

Terminal rental usually costs at least $30 a month.

What are the ‘Tap & Pay’ options with eftpos?

Contactless payments are extremely popular in Australia. And until a few years ago, eftpos cards didn’t have a tap-and-go option for card terminals.

This definitely put them behind Visa and Mastercard.

Today, eftpos uses its own Tap & Pay technology so users enjoy quick and simple transactions when spending under $200. Higher amounts require a PIN.

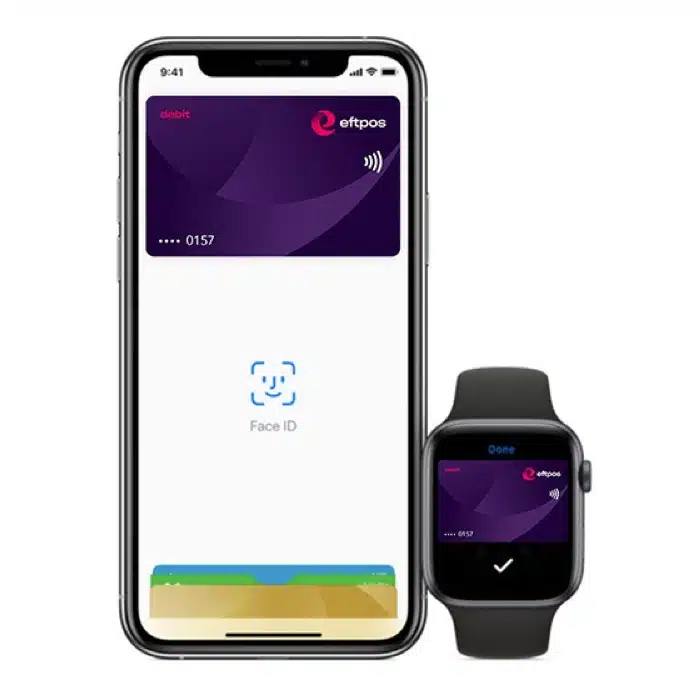

Eftpos has also slowly rolled out compatibility with mobile wallets. This allows eftpos cardholders to add the card to Apple Pay, Google Pay or Samsung Pay and pay via contactless that way.

Compatibility with your mobile wallet is available to cardholders from most major banks and financial institutions.

Eftpos can be used with Apple Pay.

More recently, merchants started accepting eftpos via Tap to Pay on iPhone or Android. This is when customers tap their card or phone on the merchant’s phone to pay via contactless.

Online payments only slowly evolving

Eftpos is still lagging behind when it comes to shopping online. It seems quite odd to think that a major payment system could be missing in online shops.

But in early 2022, eftpos finally became available for certain Card On File payments, such as subscriptions.

The eftpos website claims that other online payments are in the picture moving forward, but this has been the case for some time now. So it becomes a bit hard to tell how committed they actually are to it.

With the additions of mobile wallets and Tap & Pay, eftpos may realise they can lose a lot of ground to competing systems. And genuinely wanting to stay in the game means that allowing online shopping must be a priority for the company.

With no recent updates on their website about it, we might still be waiting a while for any real changes. And until this happens, Visa and Mastercard will be the choice for Australians who shop online.

Still dominant, but lagging in one area

With a recent boost to profits, eftpos is still a popular debit system. There’s no doubt about that.

But with some of its market share being eaten into by competitors, the Australian payment system will need to allow online purchases more broadly if it wants to remain relevant.

Small steps are being taken, but with Visa and Mastercard debit available from almost every card provider, it might be fighting a losing battle.