Pros: Local accounts in multiple countries. No monthly fees. Good rates for international transfers. Personal onboarding and customer service.

Cons: Limited app. Availability of accounts and capabilities can be confusing.

Airwallex used “better than a bank” in the first year of its marketing. We opened an account with Airwallex as we were fed up with the high fees, frustrating customer service and terrible online interface of the business account we had at a traditional high street bank.

Turned out the “better than” claim was true.

The upbeat and contemporary interface of Airwallex made checking the account almost too much fun. We were probably checking it more than we truly had to, just because the interface was so intuitive and informative.

Airwallex is not a bank, even though it works like one. It’s an e-money institution that cooperates with a number of banks to offer business accounts around the world.

Founded in Australia in 2015, it later operated out of Hong Kong, but has since moved its global headquarters to Singapore. It grew rapidly during Covid in Asia and Europe and expanded to the US in 2024.

It is not the first, nor the last, company aiming to change payments and make money borderless for businesses. We will come back to how it compares to Wise, Revolut Business, PayPal Business and others.

What are the alternatives?

Best business accounts for small businesses

Who can open an account?

Airwallex offers an attractive selection of local bank accounts in multiple countries and currencies. International transfers are cheap, but the service is not yet for businesses anywhere.

While the geographical scope has grown since we joined in 2021, especially by expanding to the US and several Asian countries, businesses in South America (except Mexico), Africa and the Middle East (except Israel and UAE) are not yet eligible.

Currently, Airwallex is available to businesses registered in 53 countries and territories (list above updated in November 2024) through 10 onboarding hubs.

The UK onboarding hub also caters to Switzerland, Israel and UAE. Sign-ups from Western Europe are typically handled by a team in the Netherlands, while Eastern Europe is onboarded by a Lithuanian hub. In Asia Pacific, Airwallex has onboarding hubs in Malaysia, Singapore, Hong Kong, Australia and New Zealand.

Account opening is not guaranteed – see more in the “signing up” section.

Fees: affordable currency exchange at the core

Airwallex pricing is really straightforward: there is no monthly fee, registration cost or commitment. If you only receive and send money in the Eurozone, for example, there are no fees at all.

A main motivation for businesses to register is to benefit from Airwallex’s favourable currency exchange rates.

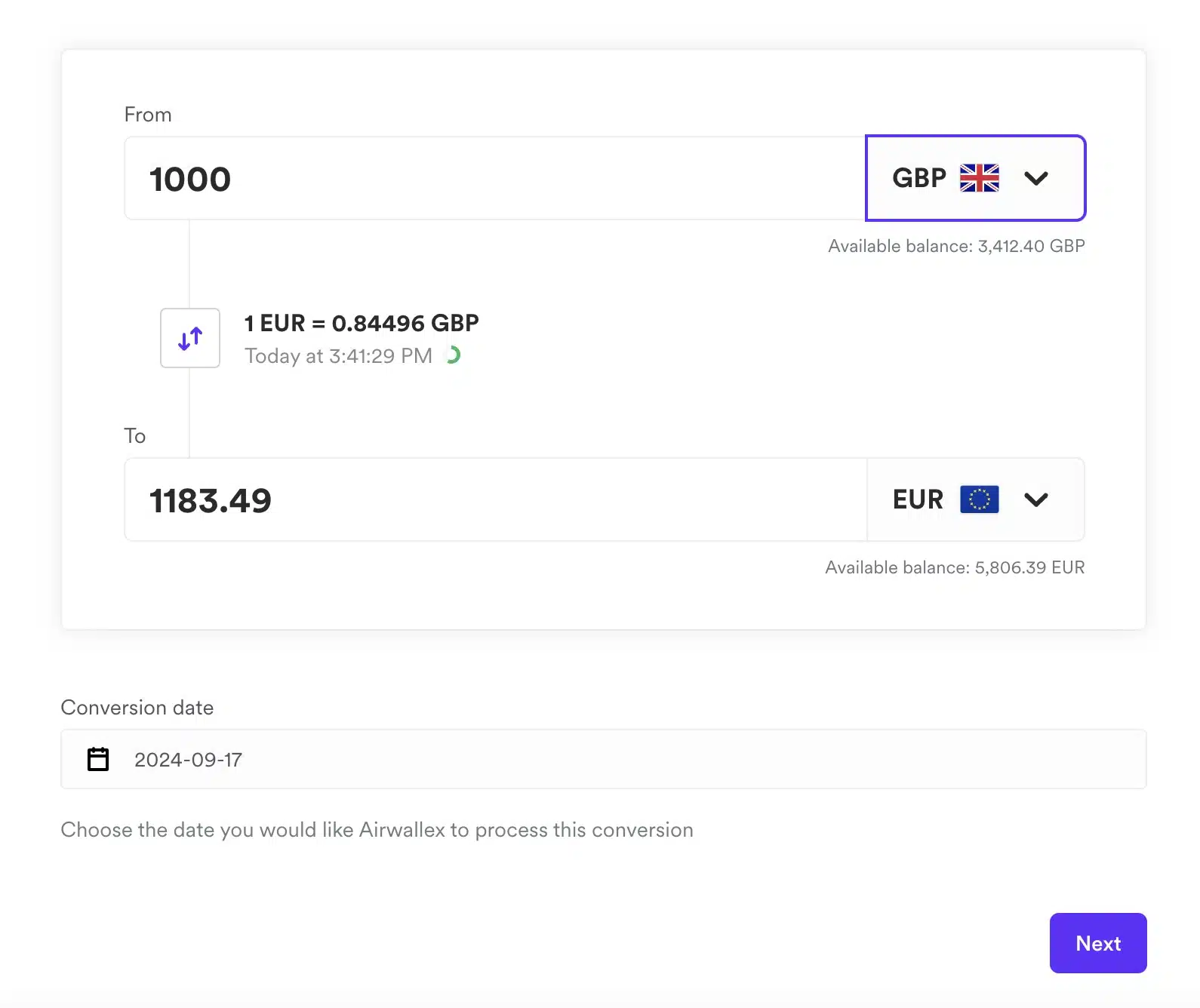

We use the exchange feature weekly, with the best rates given to instant conversion.

Airwallex says their fee is typically 0.5%-1% above the interbank FX rate. Our experience so far is that the rate is even lower.

US dollar conversion rates seem to be around 0.3%. As we kept a multi-currency account with HSBC for a number of years, we frequently compared exchange rates for similar amounts at HSBC and Airwallex. The latter was always cheaper – by quite a lot for higher amounts.

The exact rate is only known after the transfer, though. The live-rate solution means an indicative rate based on market data is displayed. Once you confirm the conversion and the transfer is made, the actual rate is displayed on the screen immediately after.

Apart from currency exchanges, there’s a payout fee of 0.1% for Chinese Yuan (CNY) and transfer fee for using SWIFT.

But with local Airwallex accounts in the countries you deal with, most businesses actually avoid SWIFT altogether. This is done by transferring money between local accounts (so only a currency fee applies), then sending the payment from the local account to your recipient within that local payment network.

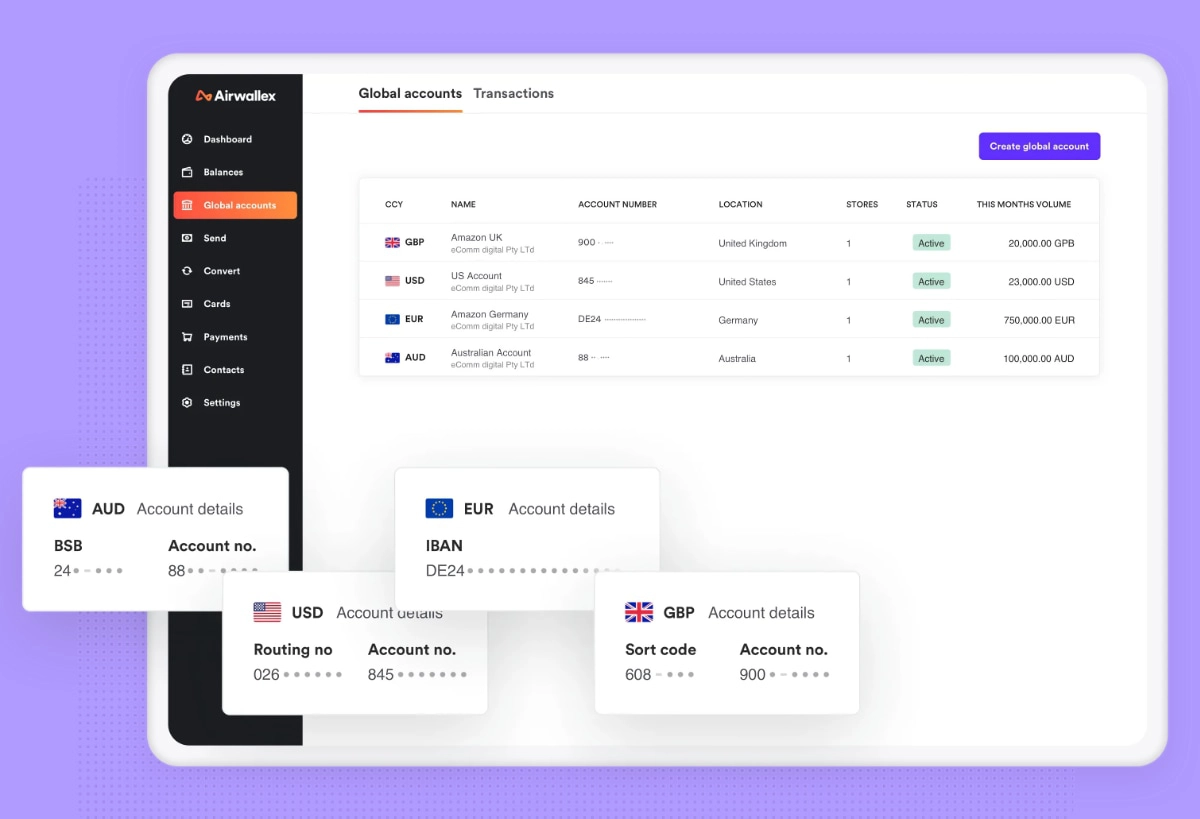

Local accounts in major currencies

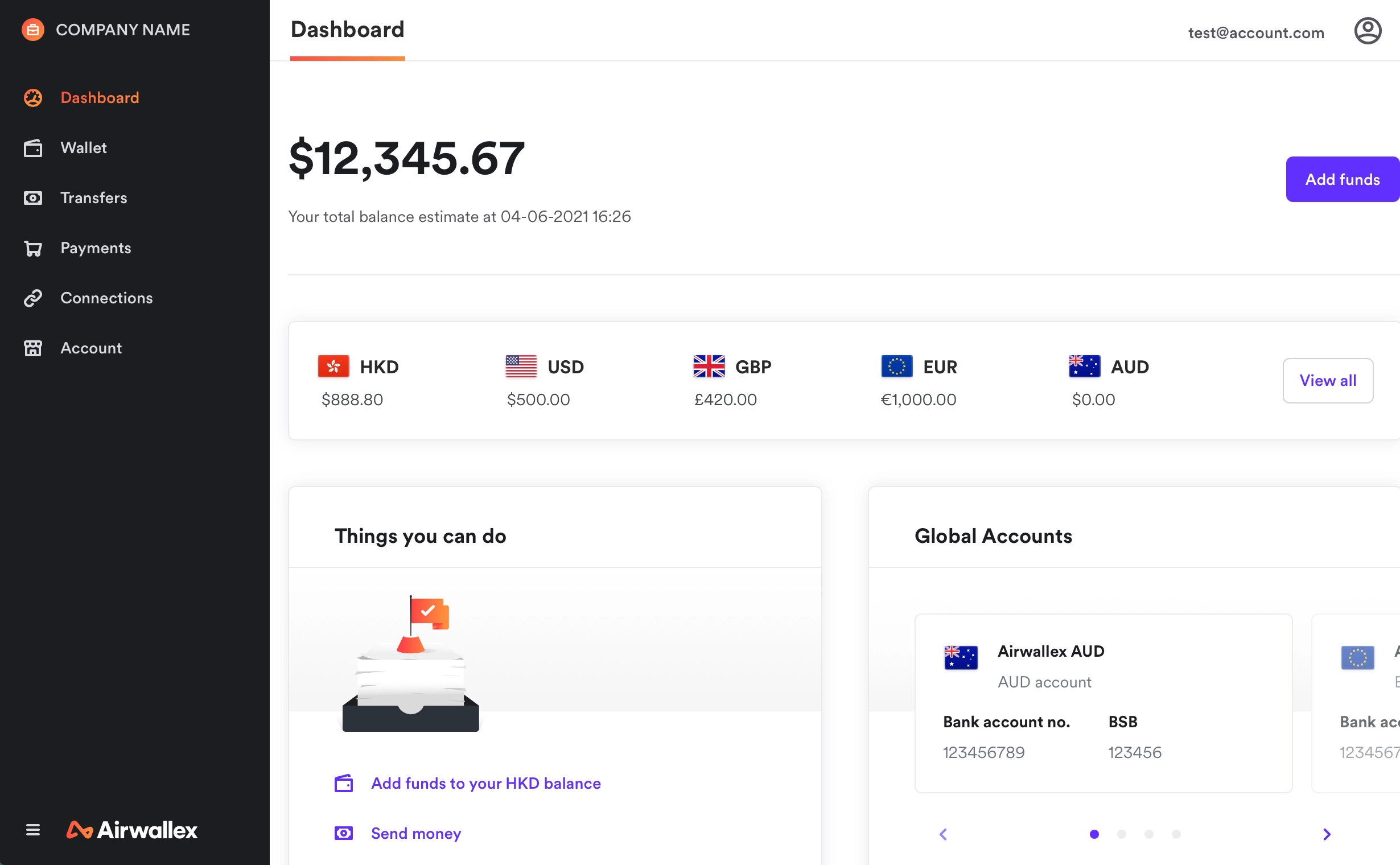

On the Airwallex website, it takes just seconds to click the “Create Global Account” button and choose whether you want a free account denominated in USD, EUR, GBP or AUD.

The currency selection varies a bit depending on which Airwallex office you sign up with. For example, a company signing up with the Hong Kong branch can see JPY, but would need to set up AUD separately as it is governed by a different legal entity.

Most accounts are set up instantly and held with banks actually located in countries using those currencies.

For example, we were able to set up both a EUR account in Hamburg (Germany) and USD checking account in New York – all in a New York minute. These accounts essentially receive payments with zero fees.

The ultimate destination for your account-creating frenzy seems to be Hong Kong, where it’s possible to open accounts in no less than 11 currencies, including the ones mentioned above, but also others like SGD, CNY and NZD. Unsurprisingly, the currencies by local banking partner DBS Bank is rather Asia-centric.

If your customers in the Single Euro Payments Area (SEPA) – where some countries have their own non-euro currency – wish to send you money, they need to be sending euros, according to Airwallex.

We tried transferring another currency to the Euro account in Estonia, and it was not converted, but simply rejected. This could be an issue with automated platforms that only give you one account number for multi-currency payouts.

Jack Zhang

Airwallex CEO and co-founder Jack Zhang was born in Qingdao, China. As a teenager, he moved to Australia where he went to high school and studied at the University of Melbourne, then worked in financial services.

The idea for Airwallex came from co-founder Max Li who was running a retail business and importing a lot from Shenzhen to Australia. The high fees for international payments and currency exchange led them to think there has to be a better way.

Airwallex does not offer accounts in Swiss Franc or European fringe currencies like Danish kroner, Norwegian kroner and Swedish krona. Nevertheless, you can exchange euros to the desired currency and make the wire transfer in the local currency.

We tried this for Norwegian kroner, but found that the exchange rate was slightly poorer than the one offered by a main bank in Norway. Typically, smaller European currencies carry a transaction cost of around 1%.

The Global Accounts come with unique account numbers, SWIFT codes and routing numbers. But they are not like the real bank accounts we are used to. They merely act as collection points for what Airwallex calls the ‘Wallet’.

So instead of being kept in a bank vault in the country where they were collected, all the US dollars pouring in through your global accounts around the world end up in your digital Airwallex USD Wallet. From there, you can easily transfer or exchange them to other currencies at very low rates.

| Country | Currency | Account receiving capabilities |

|---|---|---|

| UK | GBP | Domestic, BACS, CHAPS, FPS |

| USA | USD | ACH, Fedwire, SWIFT |

| Germany | EUR | SEPA |

| Estonia | EUR | SWIFT, SEPA |

| Hong Kong | USD, HKD, CNY | SWIFT |

| Australia | AUD | BSB, SWIFT |

While many of the local accounts/Wallets can process SWIFT, the British one cannot. This means it does not receive non-Airwallex transfers from abroad, only local payments.

With Wallets in other countries, however, you can just ask clients to transfer money into one of those, say a German account, and then transfer that to your UK Wallet with Airwallex’s low exchange rate.

The Airwallex account is managed in a computer browser.

Airwallex has customisable security features. Using two-factor authentication (2FA) is optional, except where required by law. For convenience, we tried to enable 2FA only for initiating transfers, which is an option in the interface, but it became mandatory for logging in as well.

Only recently was an Airwallex iOS app released. Because it is brand new, many features are missing, so it will take a while for it to be as useful as the dashboard. The app does, however, give an overview of your accounts, balances and transactions, plus you can convert funds between Wallets.

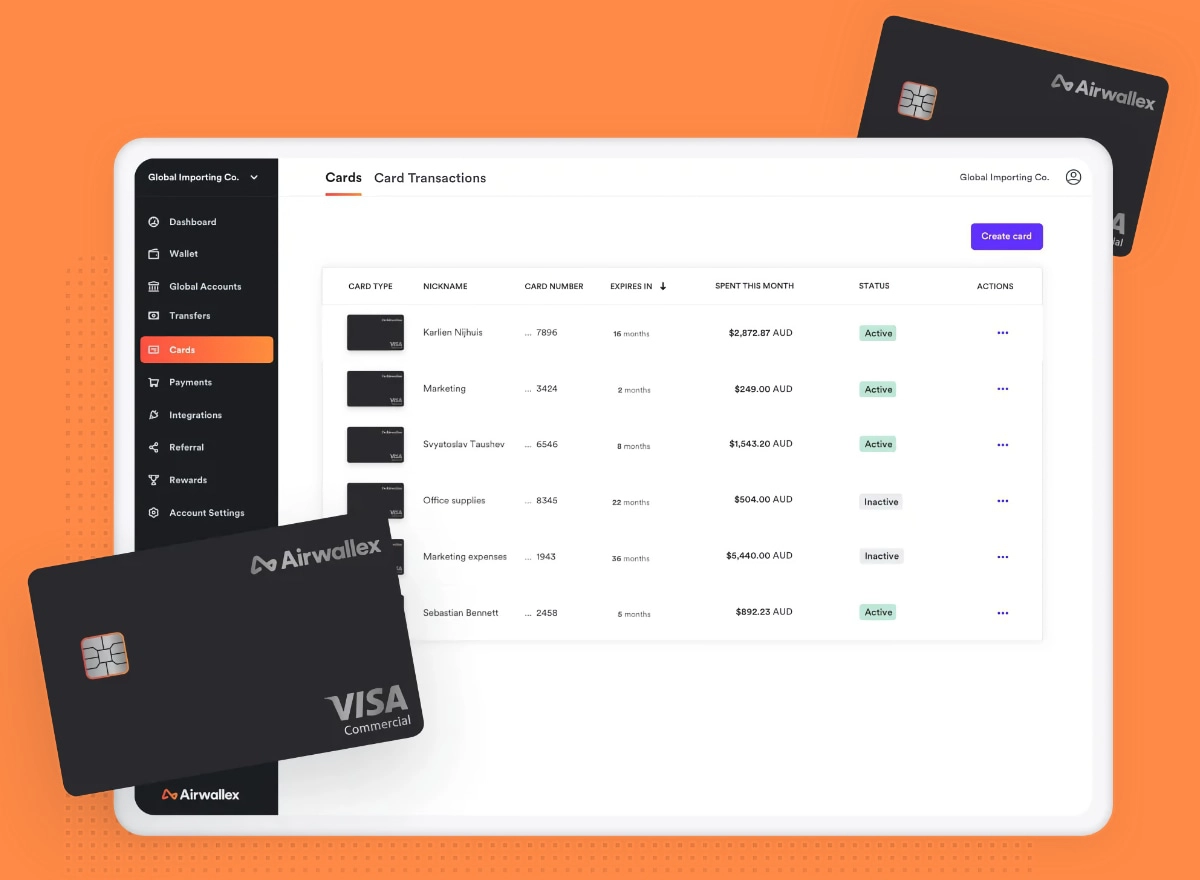

Access to funds with Visa Business card

At the moment, only businesses in the UK, US, Europe, Canada, Australia, Singapore and Hong Kong can add business debit cards to their account, but Airwallex plans to expand this service.

Businesses in these countries can get both virtual company cards in the name of the company (not an individual) and virtual employee cards cards. In our experience, both are super-quick to activate.

Physical employee cards can be ordered in the above countries and regions except for Canada.

Airwallex cards are added and managed in the online dashboard.

The virtual cards have a cardholder name, card number, expiry date and CVV code. These can be used purely for online purchases and subscriptions.

The main advantage is that card transactions automatically use the Wallet matching the transaction currency, so there’s no conversion fee. This is only available for 10 currencies: USD, EUR, AUD, CAD, HKD, SGD, CHF, NZD, JPY and GBP.

We’ve definitely saved on online purchases with this feature, but it’s annoying to see charges in more niche currencies, even when we have had funds in those wallets.

If there’s a currency exchange, you get competitive FX rates and a low conversion rate when using the card, so it’s much better than a normal bank card for cross-border transactions.

Accepting payments online

Airwallex not only receives wire transfers in bank accounts, but also serves as a payment gateway to compete with Stripe and PayPal. Accepting multiple currencies without being forced to convert is one benefit, the other is the acceptance of a wide range of cards and local payment methods.

The many ways to accept payments include:

- Checkout integration on an existing website

- Plugins for WooCommerce, Shopify, Shopline and Adobe Commerce (Magento)

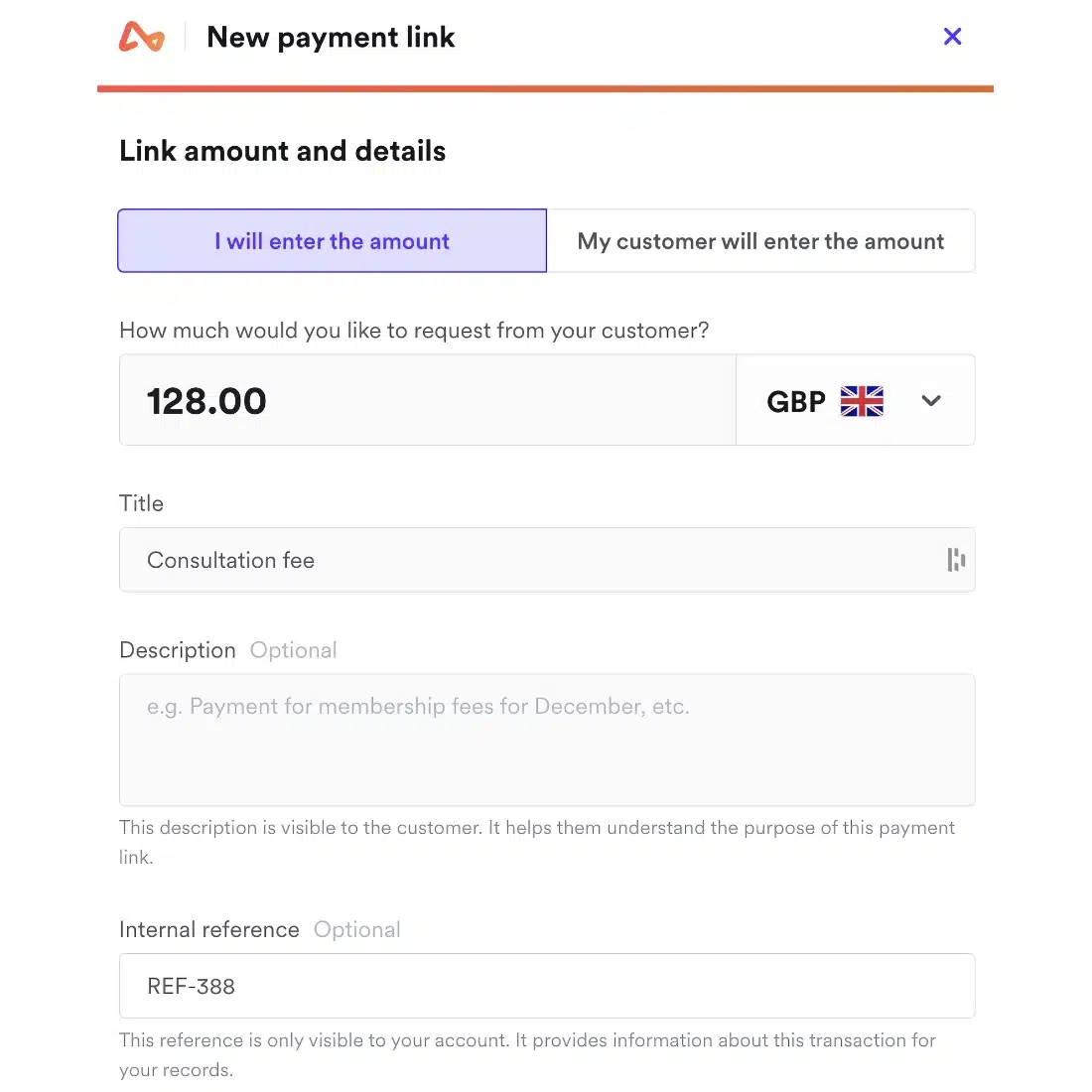

- Custom payment links with optional QR code for social media, SMS and email

- Invoice integration with Xero and Netsuite

- Customisable APIs

Airwallex promises users can accept Visa and Mastercard straight away, and that is also our experience.

Then it starts to get interesting. There is a long list of other payment methods to choose from. Some are open to all, like American Express, Klarna, Google Pay, Apple Pay, PayPal and Skrill.

Image: Mobile Transaction

We find it quite easy to create and send a payment link from the Airwallex account.

The 160+ local payment methods (as of November 2024) accepted depend on where your business is incorporated. Some popular ones are WeChat Pay, Alipay, iDEAL, Satispay and Sofort.

The fees are fairly competitive, but not necessarily the best. Like us, you would opt for Airwallex payments because of the time and money saved. Its fees switched from interchange++ pricing when we started out to a range of blended rates now.

Visa and Mastercard consumer cards typically cost 1.3% + €0.25/£0.20. Business and premium cards usually cost 3%, but as long as you accept mostly consumer cards, the total costs will be better than Stripe’s.

For businesses with regular clients, direct debit methods are very competitively priced. SEPA direct debits are €0.05 and Canadian Pre-Authorized Debits are CAD $0.05.

Reports and integrations

The Airwallex account contains the usual balance overview and transactions reports expected in any business account.

On top of that, Airwallex automatically integrates with Xero. It actually updates hourly, as opposed to most banks that only sync transactions with your accounting software once a day. You can even have separate bank feeds in Xero for each currency in Airwallex, making it easier to track payments and balances.

We’ve tested the Xero-Airwallex integration for one month with USD, euro and GBP, and the multi-currency account sync has worked perfectly. Most Airwallex accounts require a premium Xero subscription, though, except for the GBP Wallet that works with a standard Xero subscription.

What about ecommerce integrations? Airwallex has its own online payment gateway that experienced developers can install in compatible website builders. This way, you can sell in multiple currencies and avoid exchange fees when funds go into the Airwallex account.

Limitations: not all accounts accept SWIFT

There are important and somewhat confusing caveats.

The accounts you get in the UK, US and Europe are in your company’s name, e.g. Acme Limited. This looks very professional and respectable.

When we opened an account, the plethora of accounts available in Hong Kong had the characters ACC- in front of the name, so the account holder’s name becomes ACC-Acme Limited. This would undoubtedly confuse bookkeepers, and if they don’t get the recipient’s name exactly right when paying your invoices, the transfers will be rejected, possibly even lost.

Airwallex has now informed us this issue is sorted – new accounts will not get the ACC naming.

Another issue to bear in mind is how much the transfer methods vary by bank and country.

Your USD account in New York is wonderful. It can handle domestic ACH and Fedwire transfers as well as international SWIFT. But while the account in the UK happily accepts domestic Faster Payments Transfers, CHAPS and Bacs, it does not accept SWIFT.

Your account in Germany is good for SEPA payments, but not international SWIFT transfers. If you ask the support team nicely, though, Airwallex might open another EUR account for you elsewhere that actually supports SWIFT.

Airwallex Global Accounts use different transfer methods, which can be confusing.

Also, if you expect to receive transfers from individual persons, it’s something you need to discuss with Airwallex beforehand. Your German bank will not accept those.

The feeblest of your accounts will be the Japanese one. It cannot be used for normal invoicing, and can only accept sales proceeds from a small group of platforms in Japan such as Amazon, Apple, eBay, Google, JD.com and Shopify. This also gives us a hint at who Airwallex is targeting and who it is best suited for.

Careful onboarding, but faster than most banks

Opening accounts here and there without as much as a personal visit to a bank branch – perhaps while wearing pyjamas at home – sounds like a money launderer’s dream. Airwallex is undeniably at some risk and needs to be extra careful of who it accepts as customers.

As a result, many applications are classified as too high-risk and thus rejected, sometimes without a clear reason why. We have also seen reports of customers being terminated after a couple of weeks, when the compliance department concluded that the account terms were breached.

The polarisation of Airwallex reviews online, most of which seem to be either 5 stars or just one, seems to illustrate this.

Customers who were accepted are overjoyed with the service. Others are being declined, sometimes after a prolonged process where more documentation were requested and there was also an onboarding call before the final ‘no’.

During the application process, Airwallex requests basic company documents and ID copies and suggests they will be reviewed within one working day.

While this may be true for the simplest cases, additional documentation is often required, like an organisation chart indicating beneficial owners. This can prolong the process by a few days.

Attentive customer service

While some businesses experience a lengthy application process or are rejected, the ones who pass the sign-up typically have a great experience. We were assigned a relationship manager after passing the KYC (“know your customer”) process.

After the account verification, a 30-minute introductory chat is offered to showcase the platform and discuss ways to use it. You can book a slot from your relationship manager’s calendar, and they will be your contact point going forward.

We found the assigned relationship manager to be knowledgeable and highly attentive. Email queries seemed to attract a personal response very quickly.

This is in contrast with many online business accounts who have received a bad rap for customer support, for instance Revolut and PayPal.

Of course, the whole point of a user-friendly service like Airwallex is that it should be self-service with ease. In the last two years, we only needed to contact Airwallex once, and that was to ask for a specific verification document as part of a KYC process with a customer of ours.

Working as a sole trader?

Best business accounts for freelancers

Our verdict

If you handle multiple currencies and want better control over exchange rates and transfer fees, Airwallex is a welcome alternative to most bank accounts.

It’s extremely cheap for companies that receive and send money in the same major currencies, as you can completely bypass fees with the different local accounts. When you do need to convert currencies, the cost is very low compared with most cross-border payment solutions.

The service is not fully developed, and you might not access all your currencies and local accounts right away. It also seems that Airwallex is geared towards online companies that don’t need to pay for anything in person or just use the account for online payments.

For most businesses, it won’t be a standalone business account, but it is a great supplement that integrates seamlessly with Xero and saves you both time and money.